A new survey shows a majority of bank leaders believe agentic AI will fundamentally reshape the industry, and many of them aren’t waiting to get on board.

The report, commissioned by SoundHound AI and conducted by Arizent’s American Banker, polled 200 qualified managers, executives and directors working at US retail, commercial banks and credit unions, with assets ranging from under $10 billion to more than $1 trillion.

The survey finds that 70% of US banking leaders now expect agentic AI, systems that take action on behalf of users, to have a “significant or game-changing” impact on the banking industry. In terms of adoption, 51% of surveyed institutions say they are either deploying or piloting agentic AI.

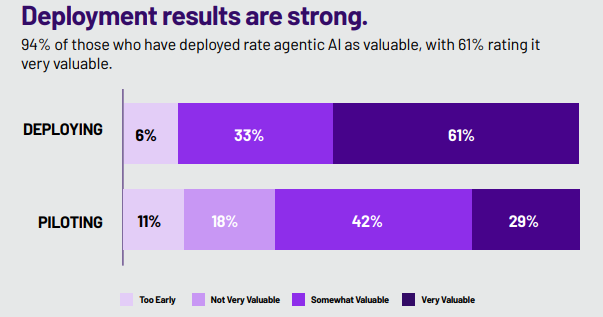

Among those that have deployed agentic AI, 58% say it is a game-changer, while 15% of those in the pilot phase share the same sentiment.

“Perception of value grows with adoption. Those who have deployed are 2x more likely to cite agentic AI as very valuable. Those stuck in the ‘pilot’ stage have mixed results and perception, and may require maturation in strategic direction, data readiness, or technology partners.”

Turning to how banks leverage agentic AI, the research says banking leaders have consistently named unlocking customer self-service, employee helpdesk and efficiency and fraud detection and compliance automation as the top three use cases.

According to SoundHound AI, banks see customer service as the fastest and most impactful entry point for AI agents.

“Agentic AI makes true self-service possible — from managing accounts and spending to re-ordering lost cards and more.”

Banks also say that agentic AI can resolve IT and HR concerns instantly without human support, while institutions, specifically smaller ones, find the technology critical for protecting customers against fraud.

“Banking is entering a new era where customer expectations, cost pressures, and compliance demands are colliding. Agentic AI’s role in this is no longer a distant possibility.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.