Registered investment advisors (RIAs) are facing a new wave of technology-driven threats, with data breaches and AI errors now among their top risks, according to a new industry survey.

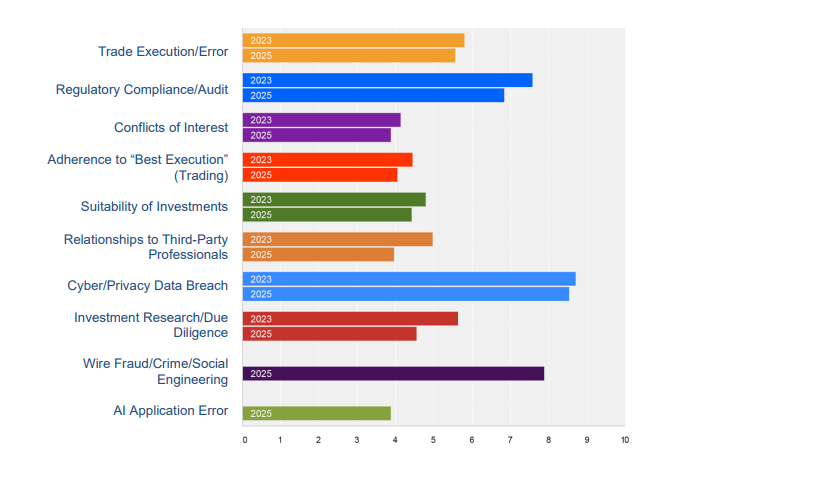

The 2025 RIA Risk Survey, conducted by brokerage firm Golsan Scruggs, surveyed 8,000 RIAs across the United States from May through August of this year to rank areas of risk from lowest (1) to highest (10).

The poll finds that RIAs are most concerned about cyber/privacy data breaches, ranking it at around 8.5. As defined by Golsan Scruggs, the risk involves the theft of clients’ private information and abuse by employees and third-party vendors.

“The subject of cyber security has been a ‘hot button’ item for several years at the SEC (Securities and Exchange Commission) and continues to be at the top of their priorities.”

Survey results also show that AI, once viewed as a purely efficiency-enhancing tool, is now classified as a potential source of operational and fiduciary risk. RIAs gave AI application errors a 3.9 risk rating, with Golsan Scruggs noting that due diligence is a must before integrating artificial intelligence into an advisory firm.

“Artificial Intelligence (AI) is a new frontier of risk, and much of this risk is unidentified. Issues of data accuracy, lack of data training, application failure, tampering, deep fakes, technology crashes and improper calibration open a broad range of new risks to advisory firms.”

According to Golsan Scruggs, RIAs will be the ones at fault in the event of AI application errors.

“RIAs must analyze how the technology interacts with and potentially breaches the established duties of loyalty and care. The core risks arise from AI’s limitations, such as inaccuracy, bias, and a lack of transparency, combined with a fiduciary’s failure to conduct sufficient oversight. Courts and regulators will hold fiduciaries, not AI, accountable for any resulting harm to clients or beneficiaries.”

Other risks covered by the survey include trade execution/error, regulatory compliance/audit, conflicts of interest, adherence to “best execution” trading, suitability of investments, relationships to third-party professionals, investment research/due diligence and wire fraud/crime/social engineering.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.