A Wall Street veteran known for calling major market turns says fears of an “AI bubble” are misplaced and may even be a bullish signal.

In a new QuickTakes post, Ed Yardeni of Yardeni Research raised his year-end S&P 500 target back to 7,000, citing robust economic data and the potential for more rate cuts this year.

Yardeni began the year with the same target but trimmed it during the summer over trade tensions before reversing course this fall.

“As promised, we are increasing the odds of a meltup to 30% from 25% and reducing our base-case for a sustainable bull market (i.e., without a correction) to 50% from 55%. Our odds of a correction (or worse) remain at 20%.”

He says investors worried about artificial intelligence mania are missing the deeper story: real earnings, real demand, and a resilient economy. He argues that the anxiety around AI-driven valuations mirrors the skepticism that often precedes long-term rallies.

“When the tech bubble in the stock market inflated during 1999, we don’t recall as much chatter about a bubble as we are hearing today. From a contrarian perspective, it is comforting that there is a bubble in bubble fears.”

He points to data showing that online searches for “AI bubble” have skyrocketed in recent weeks.

“The Google Search index for ‘AI bubble’ rose from zero in mid-September to 100 on October 2.”

According to Yardeni, the difference between today’s AI rally and the dot-com era is tangible profit.

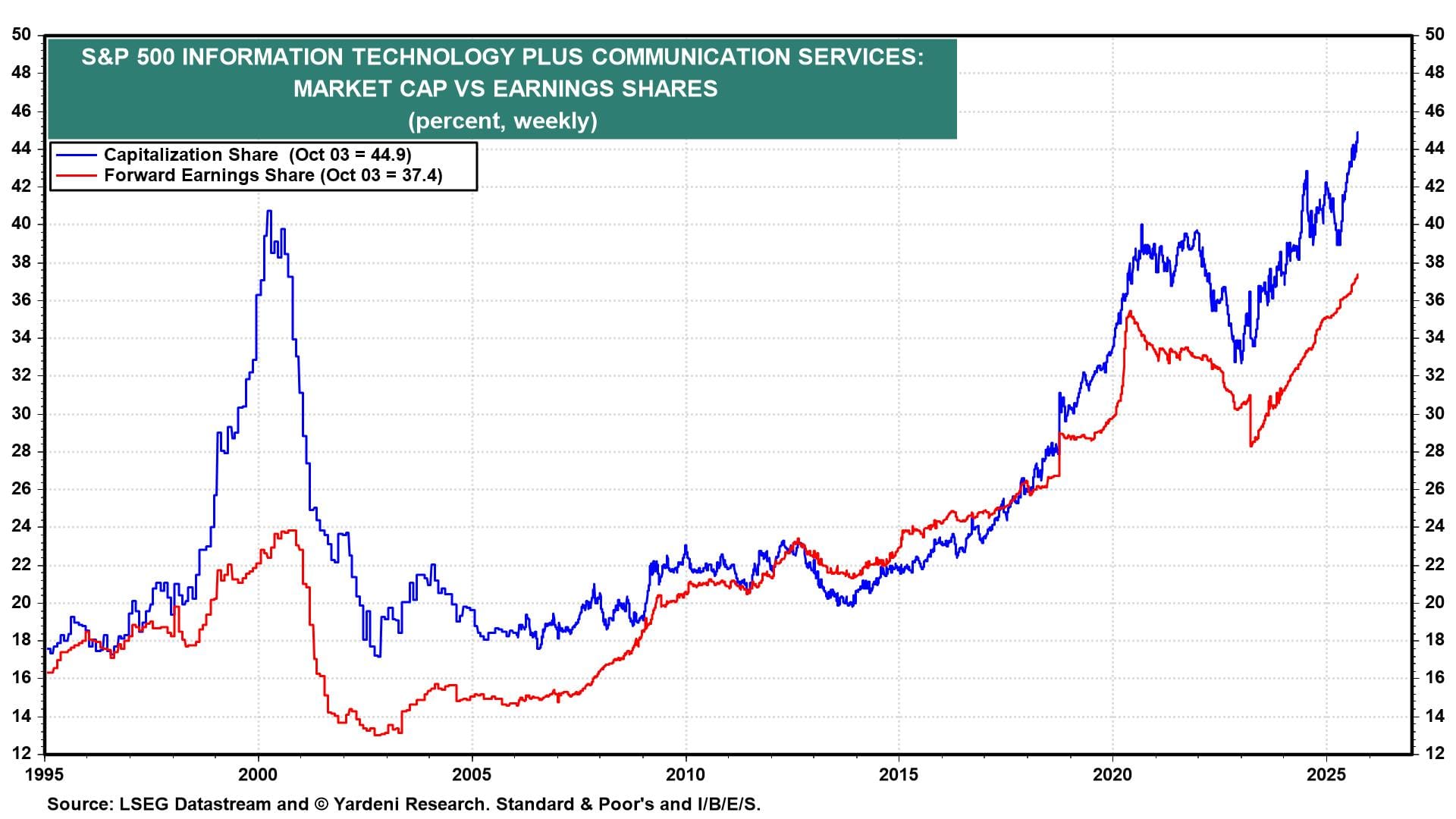

“The bubble in technology-related stocks today has less air than the one during 1999. Today, the S&P 500 Information Technology and Communication Services sectors account for a record 44.9% of the index’s market capitalization and a record 37.4% of the index’s forward earnings. During the Tech Bubble of 1999-2000, their combined market cap and forward earnings shares peaked at 40.7% and 23.8%.”

Yardeni sees third-quarter earnings exceeding Wall Street’s expectations, with large banks, AI, and cloud firms leading the way.

“We are counting on another better-than-expected earnings reporting season for Q3 over the next few weeks to support the stock market’s rally to record highs. Industry analysts are currently predicting that the quarter’s earnings will increase by 6.4% y/y. We are expecting a 10.7% increase. We expect the large banks to start the season around mid-October with upside earnings surprises. In addition, we expect that the AI and cloud companies won’t disappoint either.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.