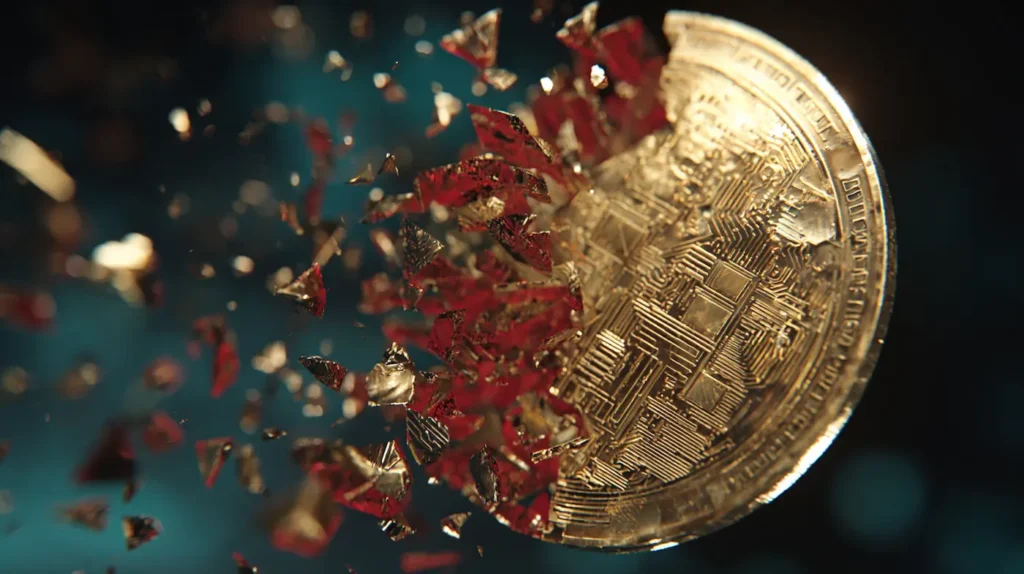

OpenAI CEO Sam Altman is warning that the artificial intelligence (AI) boom will wipe out fortunes as valuations spiral out of control.

In an interview with The Verge, Altman compares the AI frenzy to the dot-com bubble witnessed in the 1990s, highlighting that it’s “insane” for three people with an idea to raise billions of dollars worth of investments.

“If you look at most of the bubbles in history, like the tech bubble, there was a real thing. Tech was really important. The internet was a really big deal. People got overexcited…

Someone is going to lose a phenomenal amount of money. We don’t know who…”

The remarks follow a year of record fundraising across AI, including multi-billion-dollar rounds for new firms led by former OpenAI executives such as Safe Superintelligence and Thinking Machines.

Economists share Altman’s concerns. Torsten Sløk, chief economist at global investment manager Apollo Global, says leading AI stocks are significantly overvalued and may face risks greater than the dot-com crash.

“The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s.”

Meanwhile, an MIT study finds that 95% of enterprise AI projects fail to generate returns, underscoring how little profit backs today’s valuations.

Altman says OpenAI itself will endure the shakeout, forecasting that those who survive will make a “phenomenal” amount of money.

“You should expect OpenAI to spend trillions of dollars on data center construction in the not very distant future. You should expect a bunch of economists to wring their hands.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.