Michael Burry is escalating his attack on Palantir’s (PLTR) valuation, noting that the company’s core business model may be fundamentally broken beneath its artificial intelligence surge.

In a new post on Substack, the Big Short investor scrutinizes Palantir’s net dollar retention (NDR) data and ties it to former employees’ accounts of how the software actually operates in practice.

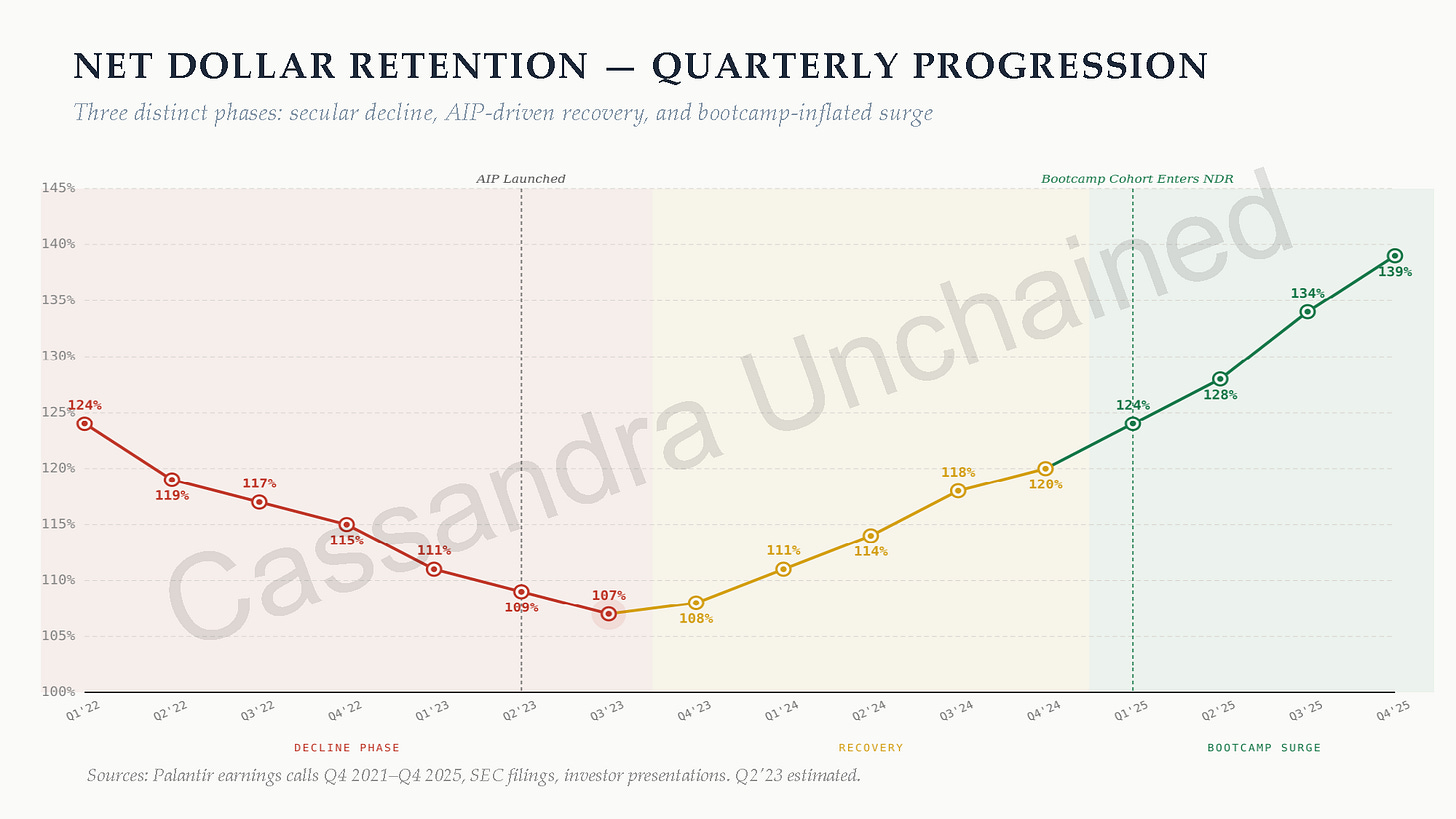

Burry says NDR is the structural backbone of Palantir’s strategy, laid out in its 2020 S-1 prospectus as an “Acquire, Expand, Scale” model designed to steadily increase revenue from existing customers.

“If Palantir’s business model is working, that NDR should never be falling. Rising NDR is the entire architecture of the model.”

Burry explains that before the AI narrative took hold, retention trends, or the NDR escalator, were deteriorating, suggesting that the firm’s business model is broken.

“Before the AI narrative took hold, NDR was falling – from 131% to 107% in nine quarters. In a business designed from the ground up to produce rising within-account revenue, near-flat retention means the business model was not working. Customers were not being Expanded and Scaled fast enough – or at all – to justify the enormous costs of the Acquire and early Expand stages.”

He contrasts the decline with what he described as a dramatic rebound following the company’s AI pivot, driven by AIP bootcamps that added hundreds of customers.

“The AI pivot changed everything. AIP bootcamps brought on roughly 460 new customers in 2024–2025, nearly doubling the customer base. These bootcamps were shortened, cheaper Acquire stages – with less time for a customer to say ‘no thank you’ after the initial installation, as they had been doing for years.

The result is an NDR surge from 107% to 139%. 139% is extraordinary. It is also suspect. Such heights are rarely sustained and almost always associated with base effects. Customers who landed small via bootcamps at $500,000 and expanded to $2 million or more within twelve months show 300% or higher individual retention on a trivially low base, mechanically inflating the blended figure.”

Burry also cites accounts from former Palantir field deployment engineers, or FDEs, to challenge the company’s description of itself as a scalable software subscription business. He references past disputes with law enforcement clients and questions whether the company’s products function as true plug-and-play software.

“A former FDE also told me, ‘Foundry is not a perpetual license. You have to be trained to use it. Even then, you require heavy lift and continuous support.’”

Burry says such comments reinforce the view that customers are effectively paying for implementation consultants rather than scalable software subscriptions.

“Overall, I have yet to hear from former Palantir engineers telling me my thesis is wrong. I am left more convinced that Palantir does not earn the margins it says it does, does not have the earnings it says it does, and does not have the software subscription model it says it does.

Palantir is a consultant riding a bubble of AI FOMO demand, and will trade well below a $100 billion market cap in my opinion. In the long run, revenues shrink, and it is likely to be acquired for relatively cheap.”

Palantir currently has a market capitalization above $318 billion, implying a potential loss of more than $218 billion in equity value if Burry’s forecast were to materialize. The forecasted valuation appears to align with his previous call that PLTR will trade at around $50.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.