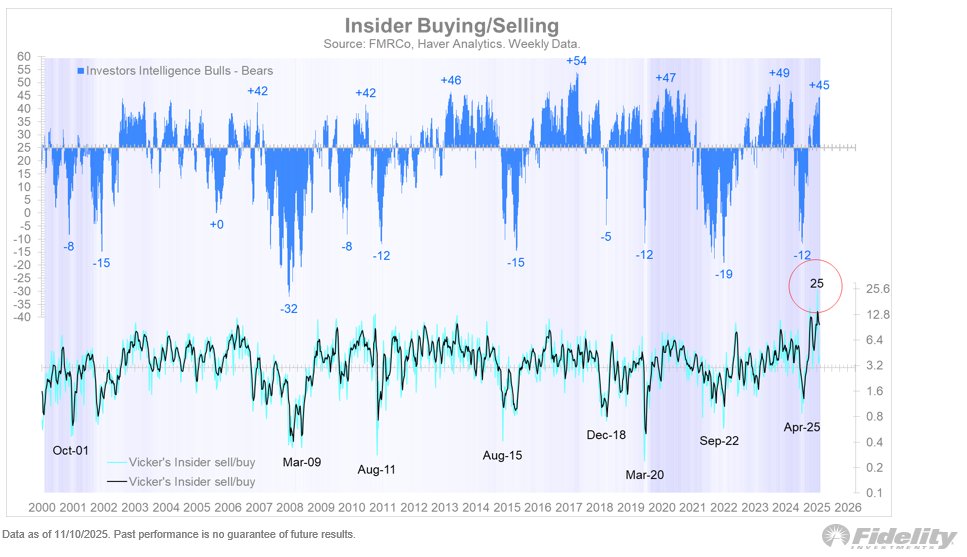

Fidelity’s Jurrien Timmer says corporate insiders are dumping stocks at a pace not seen in more than two decades.

In a new post on X, Fidelity’s director of global macro says the Vickers Insider Sell/Buy Index shows that insiders, like company CEOs and other executives, are unloading their holdings at a rate far outpacing buys amid bubble talks and risks tied to the AI buildout.

“What is catching my eye is that while sentiment is leaning bullish among retail investors and Wall Streeters, corporate insiders are selling at the highest level since 2000. The chart below shows the Vickers Insider Sell/Buy index. Typically, this index only produces meaningful signals at market lows when CEOs and the like buy their company stocks at depressed levels. They have all kinds of reasons to sell shares, including for compensation, so there is usually little signal there. That may well be the case today, but given the conversation about valuation and bubbles and loft earnings goals, the current 25:1 sell/buy ratio is something that gives me pause.”

Looking at the stock market, Timmer says he did a back-of-the-envelope calculation to check whether the market is fairly valued, as Wall Street bulls claim the AI revolution justifies current valuations. Timmer says his model suggests that the S&P 500 should be trading well below 6,000 to be fairly valued.

“I did a back-of-the-envelope exercise using the discounted cash flow model (DCF) to estimate at what combination of earnings growth and equity risk premium (ERP) the current level of the S&P 500 may be justified. Looking at the Bloomberg earnings estimates for the next few years and assuming a trend-like growth rate of 7% thereafter, the projected 5-year compound growth rate (CAGR) for earnings is 11%.

Given that 11% projection, the current level for the S&P 500 index only makes sense at an implied equity risk premium (iERP) of 3.7%…

We can use the DCF to solve for earnings growth as well, by holding the ERP constant. If the ERP were currently at its historical average of 5.0% instead of 3.7%, and we take that 11% EPS expected growth rate and plug it into the DCF model, the S&P 500 fair value drops to roughly 5,000. Ouch.”

According to Timmer, the AI boom needs to deliver massive earnings growth in the coming years to justify the market’s current valuation.

“Putting this another way, at the current price level of 6730 and a ‘normal’ ERP of 5.0%, we would need to see earnings grow by 18% per year for the next 5 years to justify the market’s current price level. It’s not impossible if the AI boom is the game changer that many expect it will be, but it’s not a small feat either.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.