Brad Gerstner’s tech-focused investment firm is close to abandoning a premier data center play while deploying hundreds of millions of dollars into three AI names.

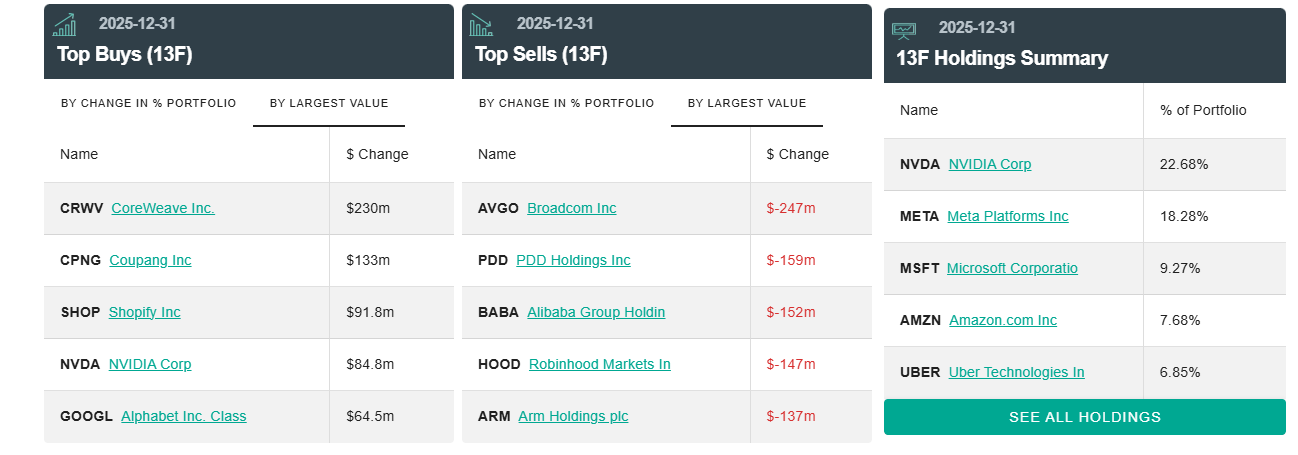

Altimeter Capital’s latest 13F filing shows that the firm dumped $247 million in Broadcom (AVGO) shares in Q4 2025.

The investment firm sold 712,647 AVGO shares to slash its stake by 96%. As of December 31st, 2025, Altimeter holds 32,129 shares in AVGO valued at $11.119 million.

In Q4, Altimeter dumped 100% of its position in Alibaba (BABA), selling 969,100 shares to recoup $152 million in capital. The firm also dropped all of its holdings in the chip-licensing company Arm (ARM), selling 1,098,139 shares for $137 million.

While selling Broadcom, Alibaba and Arm, Altimeter opened a fresh stake in CoreWeave (CRWV), buying 3,213,230 shares worth $230.099 million.

The firm also splurged $84.8 million in Nvidia (NVDA), buying 454,875 shares to bring its exposure up to 8,099,773 shares worth $1.510 billion.

And Altimeter spent $64.5 million to accumulate Alphabet (GOOGL), gobbling up 206,158 shares to boost its stake to 519,290 shares, valued at $162.537 million.

Other notable moves by Altimeter include buying 115,260 shares in Microsoft (MSFT), 48,186 shares in Amazon (AMZN), 150,550 shares in Taiwan Semiconductor Manufacturing (TSM) and 5,652,210 shares in the Korean e-commerce giant Coupang (CPNG).

Zooming out, Nvidia is Altimeter’s top holding, accounting for 22.68% of its portfolio. Meta (META) takes the second spot at 18.28%, followed by Microsoft at 9.27%, Amazon at 7.68% and Uber (UBER) at 6.85%.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.