Michael Burry says the AI capital spending boom has entered the same danger zone that preceded every major market peak of the last three decades.

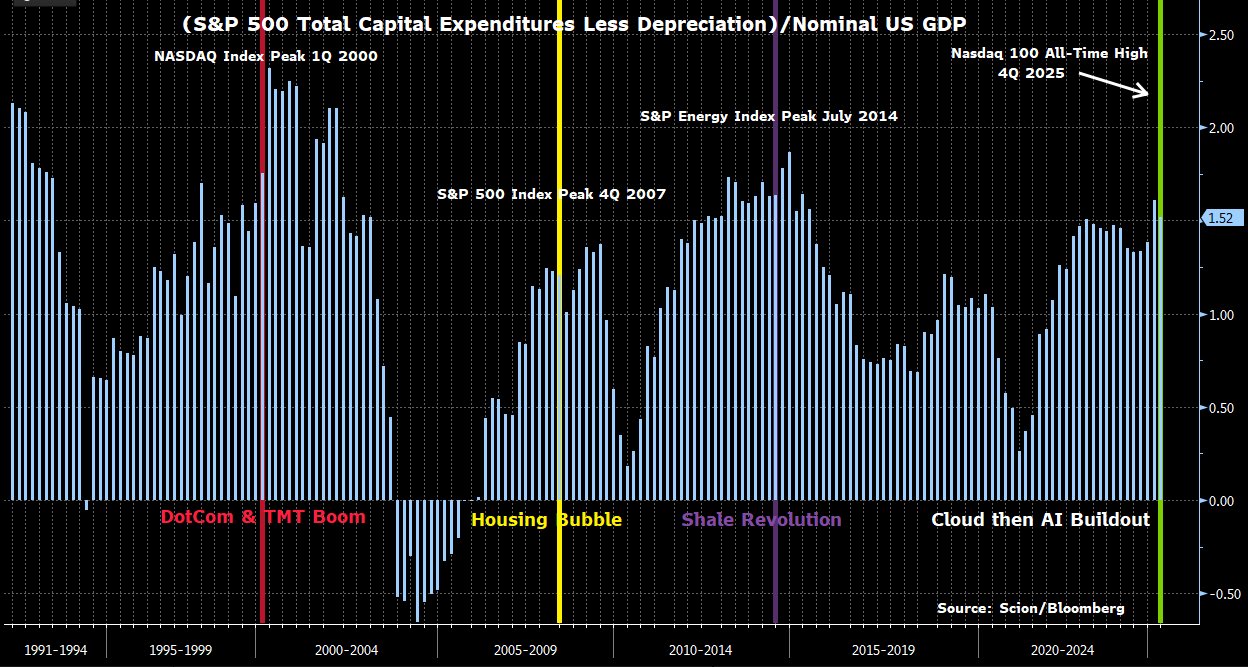

In a new post on X, the “Big Short” investor shared a Bloomberg chart tracking S&P 500 capital expenditures minus depreciation as a share of US GDP.

The series highlights four historic peaks tied directly to market blow-offs: the Dot-Com bubble in 2000, the housing bubble in 2007, the shale boom in 2014 and now the cloud and AI buildout.

The chart shows that the current investment level minus depreciation is at roughly 1.52% of GDP, matching the same range seen just before the prior three market tops. The timing also coincides with the Nasdaq 100 setting fresh all-time highs in late 2025.

Burry says the graphic is a direct rebuttal to analysts claiming today’s AI market is structurally different.

“One chart to refute them all…”

The data suggests that while AI spending dwarfs earlier tech cycles in magnitude, the macro pattern of surging investment near market peaks remains intact. The prior highs preceded crashes in 2000, 2007 and 2014.

While Burry did not provide further details on his short AI thesis, he says, “to be continued Nov 25th, or before.”

The controversial investor has been grabbing headlines since news emerged that he placed bets on the collapse of Nvidia (NVDA) and Palantir (PLTR). He has said that AI giants are committing modern era fraud by extending the lifecycle use of AI chips and hardware to understate asset depreciation and boost earnings.

Fellow “Big Short” investor Steve Eisman commented that Burry’s allegation won’t matter much if the hyperscalers see profits on their investments. Meanwhile, billionaire Chamath Palihapitiya said that Burry doesn’t have the technical grounding to understand the development of AI hardware.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.