The ghost of the dot-com bubble is back on Wall Street, and this time it’s wearing an AI badge.

In a new analysis, the Wall Street Journal (WSJ) draws striking parallels between today’s artificial intelligence boom and the late-1990s internet mania, while flagging one crucial difference that could shape how this cycle expands.

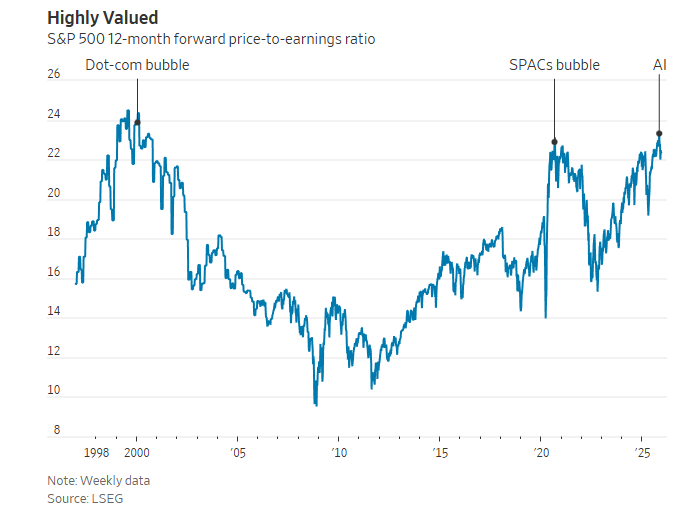

Starting with valuation, the WSJ says the S&P 500 is as expensive as it was during the dot-com era. Forward price-to-earnings ratios, price-to-cash-flow measures, cyclically adjusted PE ratios, and stock-bond comparisons all point to extreme optimism. As in 1999, investors are betting that a breakthrough technology will deliver unusually fast and durable profit growth.

Uncertainty is another echo. During the internet boom, companies were priced on the promise of future business models that had yet to prove themselves. AI today is in a similar position. Generative models feel transformative, but many are still sold below cost, with heavy losses absorbed by developers. The difference is that today’s AI leaders already have revenue, while many dot-com firms had none.

Capital spending also rhymes. The internet was built on massive fiber-optic networks financed largely with debt. AI is being built on giant data centers, requiring trillions in projected investment. The spending is so large that economists say it is now contributing meaningfully to overall GDP growth. As in the late 1990s, the “picks and shovels” sellers are winning. Back then it was Cisco, and today, it is Nvidia.

Market behavior looks familiar, too. In 1999, most stocks fell while a narrow group of internet names surged. This year, anything tied to AI is up, while large parts of the market lag. The WSJ notes that in 2025, 183 of the names in the S&P are down, accounting for 37% of the index.

Retail speculation has returned as well, with loss-making small stocks outperforming profitable peers, mirroring patterns seen in the dot-com era and again during the 2021 trading boom.

Even the debate sounds the same. Bubble warnings were constant in 1999 and did nothing to stop prices from rising further. Today’s AI market is again filled with arguments that widespread bubble talk means there is no bubble at all.

But the WSJ highlights one key difference: the scale of gains so far is much smaller.

During the dot-com peak, individual stocks routinely doubled in weeks and surged by multiples of ten. Qualcomm rose more than 2,600%. Cisco doubled in a single month. By comparison, today’s AI leaders have posted extraordinary gains, but not on the same exponential scale. Nvidia’s rise, while historic, is modest next to the most extreme moves of 1999.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.