Star fund manager Cathie Wood believes that the AI trade is going strong, despite signs of rising risks showing in the credit default swap (CDS) market.

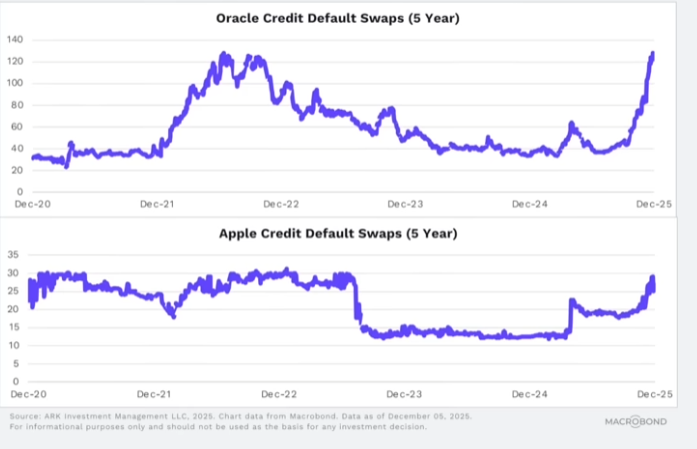

In a new video update posted on the ARK Invest YouTube channel, Wood says the rising value of CDS for Apple and Oracle is not a sign that the AI trade is in bubble territory.

Credit default swaps (CDS) serve as insurance against a company failing to meet its debt obligations.

She also notes that the uptick in CDS pricing reflects a rise in caution rather than a sign of fundamental weakness.

“Many people think AI is where the bubble and the risks are. These are credit default swaps for Oracle and even Apple. And you can see what’s happening here. These are insurance policies against defaults. And when they go up in price, it means there are investors. And we think the banks could be laying off risk here, who think that maybe the spending spree in data centers is just too much. We don’t think so.”

ARK Invest’s data shows that the CDS price for Oracle exploded this year from about 0.40 to 1.20 percentage points, tripling in value in less than 12 months. Over the same time frame, CDS for Apple surged from about 0.12 to 0.25 percentage points.

According to Wood, the rise in the value of Apple and Oracle CDS shows signs of early doubt that often sets the stage for durable gains.

“We like this wall of worry. We like the concern. Scar tissue from the tech and telecom bubble. It’s all a good thing.”

Macro investor Jordi Visser also holds a similar view, noting that the soaring price of Oracle CDS is a sign of a healthy market.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.