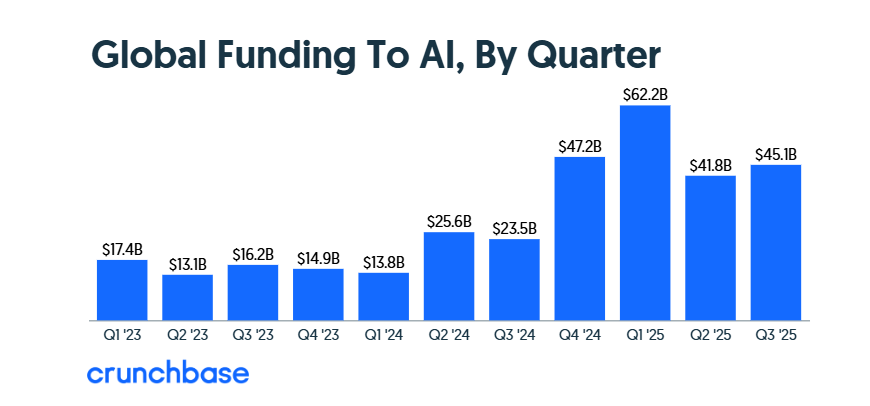

Global venture investors poured $45 billion into AI firms in the third quarter of 2025, led by massive rounds for Anthropic, xAI and Mistral AI, according to new data from Crunchbase.

In a new report, Crunchbase says AI venture investments represent about 46% of all venture capital deployed worldwide last quarter, marking a blockbuster period in which AI captured nearly half of global startup funding.

Total venture investment reached $97 billion, up 38% year-over-year from $70 billion in Q3 2024.

It was the fourth consecutive quarter with global startup funding above $90 billion—levels not seen since 2022. Crunchbase says startup investment has now posted year-over-year gains for the past four quarters, driven by “megarounds of $500 million or more, largely to AI-related companies.”

The report shows capital concentrating into fewer, larger deals.

“The three largest venture rounds in Q3 2025 were raised by foundation model companies Anthropic ($13 billion), xAI ($5.3 billion) and Mistral AI ($2 billion).”

Crunchbase says those three accounted for nearly one-third of AI’s total quarterly funding, underscoring how money is clustering around a few model developers.

“All in all, a third of all venture investment in Q3 went to just 18 companies that raised funding rounds of $500 million or more each.”

The trend, Crunchbase notes, is well above historical norms prior to late 2024.

Hardware ranked as the second-largest sector with $16.2 billion in rounds from robotics, semiconductor, quantum and data-infrastructure firms. Healthcare and biotech followed at $15.8 billion, while financial services attracted $12 billion in new capital.

Late-stage investment surged 66% year-over-year to $58 billion, helped by the OpenAI mega-round earlier in the year. Early-stage and seed funding also ticked higher, reaching $30 billion and $9 billion, respectively, across thousands of companies.

The quarter confirms that AI remains the engine of global venture capital momentum — commanding nearly half of every VC dollar deployed worldwide as founders and investors race to own the infrastructure of intelligence.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.