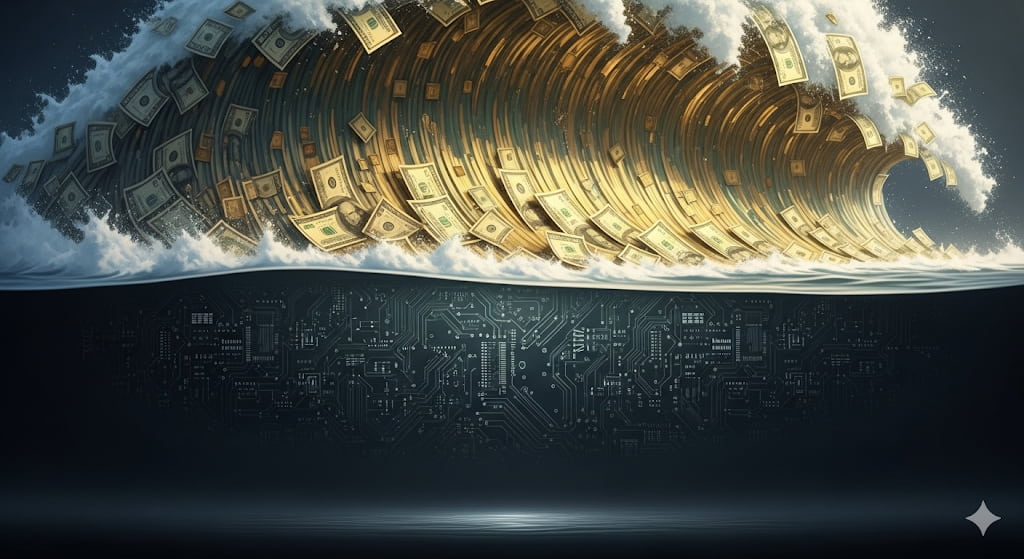

A fresh rate cut is giving new fuel to the technology rally, according to one of Wall Street’s most recognizable voices on tech and AI.

In a new Bloomberg interview, Dan Ives says the Federal Reserve’s decision to cut borrowing costs opens the door to another stage of growth in chips, software, and energy infrastructure.

He says the Fed’s action is a pivotal moment for sidelined investors to deploy their dry powder into tech, comparing the sector’s momentum to a late-night party that still has hours to go.

“To me, that’s a bright green light for more money to come off the sidelines into tech. And I think that’s really good for the bulls going into year-end.”

He ties the outlook to six specific companies he sees as central to the next wave of tech and AI acceleration.

“That’s what Tesla, to me, along with Nvidia, [the two best physical AI plays]. But then you think on the infrastructure side, you got [CoreWeave, Nebius]. You look at [GE Vernova] on the power side. [Aqua Metals] is another example of it.”

Ives also says he sees the Fed cutting cycle as rocket fuel for tech and AI stocks outside of the Magnificent 7.

“In my opinion, this is really going to turbocharge this tech rally. And it’s not just about Mag 7, but second, third, fourth derivatives.

I think tech stocks could be up another 10% between now and the rest of the year…

And guess what they’re going to spend on? AI data centers. So it speaks to our view. Like, look, tech’s had a strong year so far, but it’s get the popcorn out… It’s only 10:15, 10:30 pm in that party that goes to 4 am, started at 9 pm a year ago.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.