Crypto whales are seizing the marketwide correction to accumulate nearly $2 billion worth of Bitcoin (BTC) and Ethereum (ETH).

Data from Lookonchain shows that a whale owning the wallet with a 1F1neJ tag has taken off hundreds of millions of dollars in Bitcoin from the crypto exchanges Bullish.com and Binance.

“Whales continue to accumulate BTC despite the market drop.

Newly created wallet ‘1F1neJ’ has withdrawn 2,261 $BTC($247 million) from exchanges in the past four days.”

The blockchain tracking platform also says that over a dozen whale wallets have accumulated nearly $1.8 billion worth of ETH in just a few days.

“Whales keep accumulating ETH!

16 wallets have received 431,018 ETH($1.73 billion) from Kraken, Galaxy Digital, BitGo, FalconX, and OKX in the past three days.”

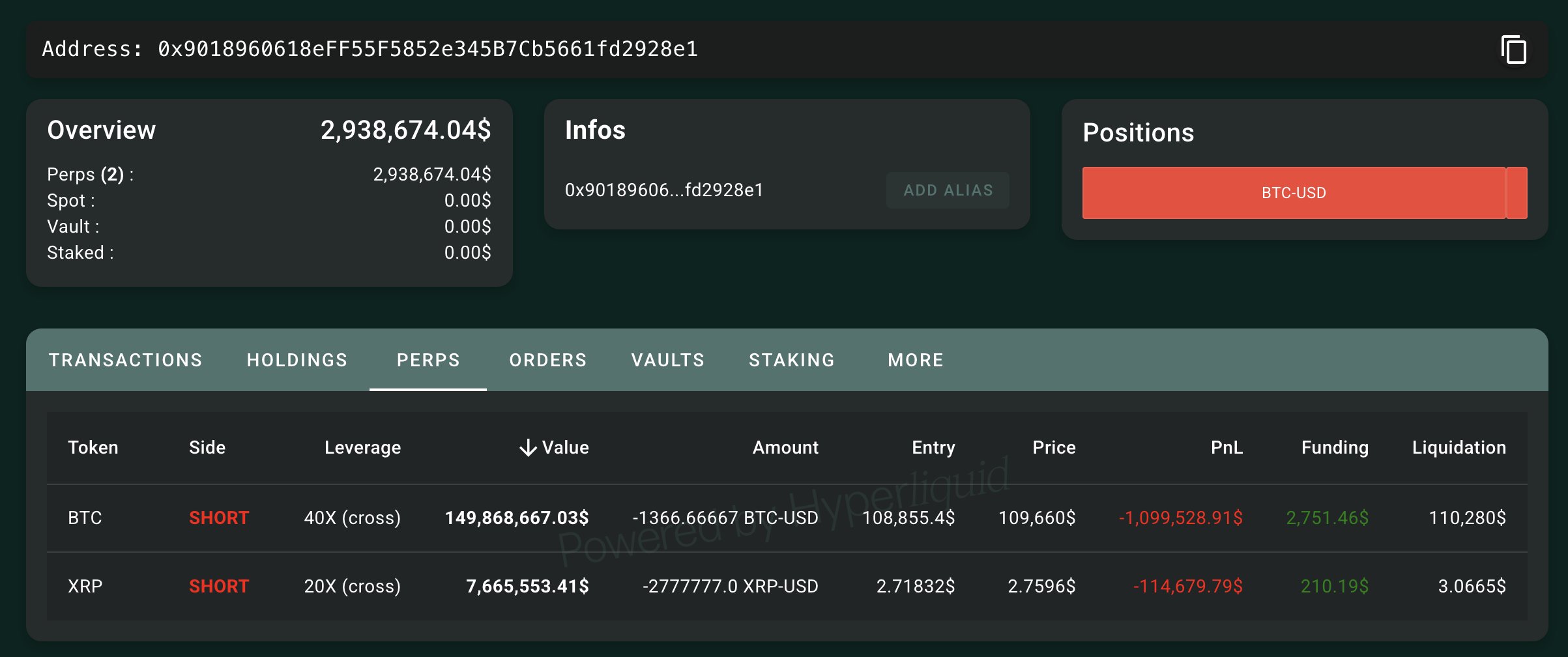

While whales are gobbling up Bitcoin and Ethereum, Lookonchain finds that one trader is heavily shorting BTC and the payments altcoin XRP. The trader is down over $1 million on his short positions as both BTC and XRP approach the entity’s liquidation levels.

“Gambler Qwatio created a new wallet 0x9018 and returned to Hyperliquid with 4.22 million USDC.

He shorted 1,366.67 BTC($150 million) with 40x leverage and 2.78M XRP($7.7 million) with 20x leverage, resulting in a loss of over $1.2 million.

Liquidation price:

BTC: $110,280

XRP: $3.0665.”

Earlier this week, two traders lost $75.3 million amid the crypto market shakeout. Lookonchain showed that a trader owning the 0xa523 wallet got wiped out today as Ethereum (ETH) plunged below $4,000. Meanwhile, a trader known as Machi Big Brother lost $30 million in less than a week.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.