Warren Buffett’s Berkshire Hathaway is rotating out of one mega-cap name while committing more than a billion dollars to energy and media.

Berkshire’s latest 13F filing shows that the holding company dumped $1.78 billion in Amazon (AMZN) in Q4 of 2025, reducing its holdings by 77% in just three months.

From 10,000,000 AMZN shares in Q3 of last year, Berkshire now holds 2,276,000 shares valued at $525.346 million.

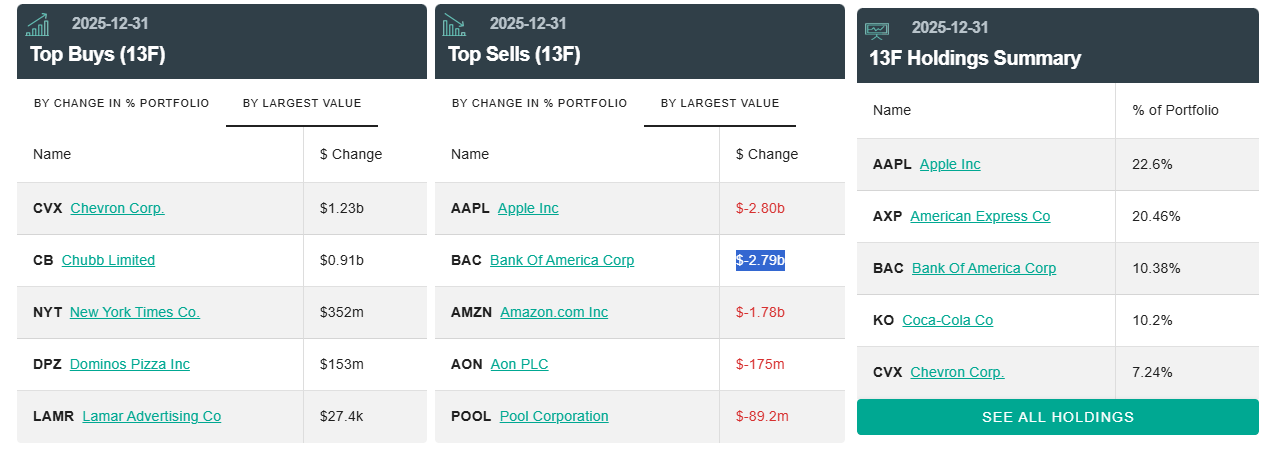

The firm also unloaded 10,294,956 Apple (AAPL) shares last quarter to bring down its exposure to 227,917,808 shares, worth $61.961 billion. Despite selling $2.80 billion in Apple shares last quarter, AAPL is still Berkshire’s top holding, accounting for 22.6% of its portfolio.

And Berkshire sold 50,774,078 Bank of America (BAC) shares in Q4, trimming its ownership to 517,295,934 shares valued at $28.451 billion. BAC accounts for 10.38% of Berkshire’s total holdings.

Meanwhile, the holding company accumulated $1.23 billion in Chevron (CVX) last quarter, to boost its stake to 130,156,362 shares, worth about $19.837 billion.

Berkshire also opened a new position in the New York Times (NYT), buying 5,065,744 shares valued at $351.663 million.

Other notable Berkshire buys in Q4 include the insurance firm Chubb Limited (CB), restaurant chain Domino’s Pizza (DPZ) and ad firm Lamar Advertising (LAMR).

Data shows that Berkshire Hathaway bought $910 million in CB, $153 million in DPZ and $274,000 in LAMR.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.