Wall Street investors are increasingly weaving artificial intelligence into their daily workflows, with new survey data showing AI is now shaping everything from earnings analysis to the search for fresh investment ideas.

According to a Brunswick Group survey of 100 US institutional active equity investors conducted between November 20th and December 4th, 2025, more than half of respondents said AI is important to their investment research process.

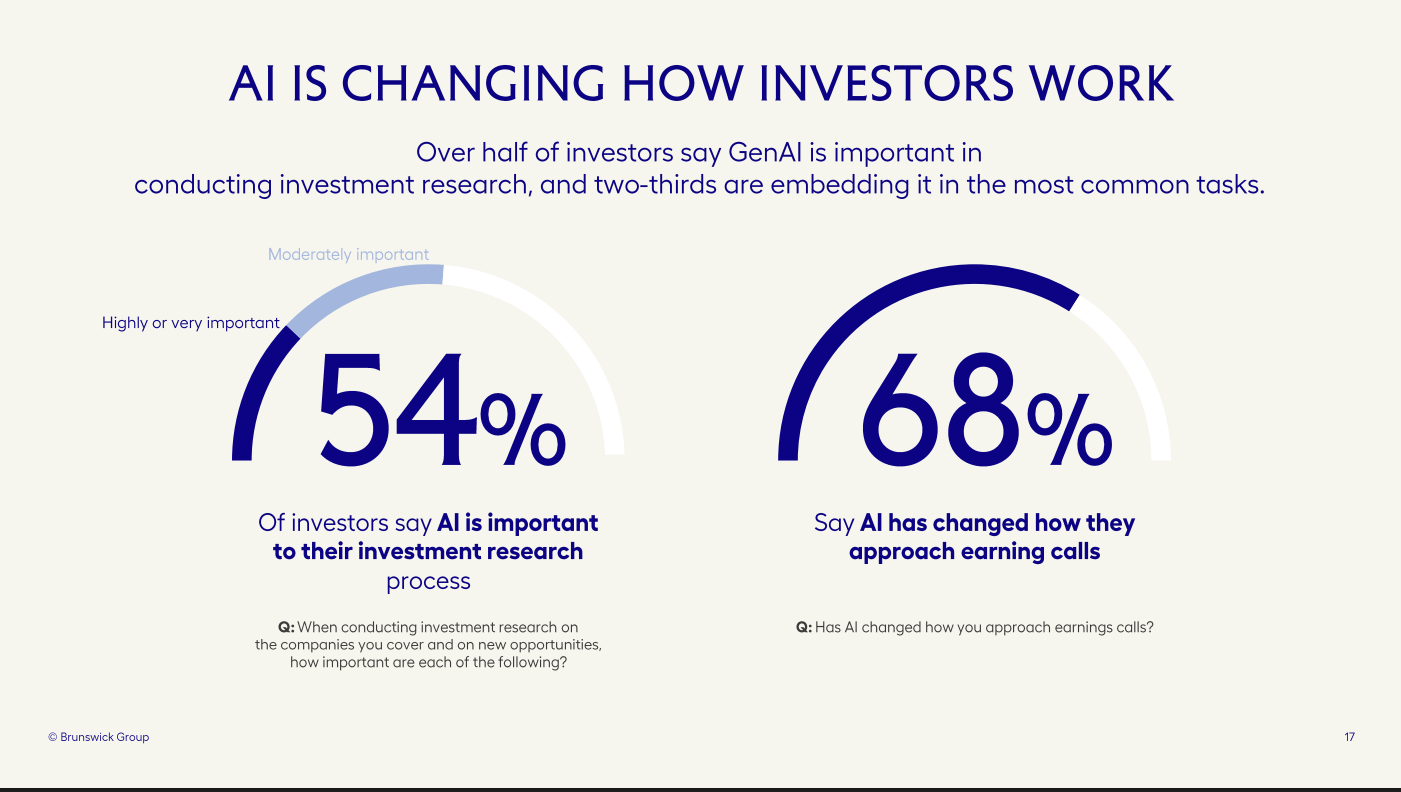

Specifically, 54% described AI as highly or very important when conducting research on companies and new opportunities.

The shift is already changing how investors approach one of their core tasks. The survey found that 68% of investors say AI has altered how they prepare for and analyze earnings calls, signaling that AI tools are becoming embedded in routine decision-making rather than used only on the margins.

Brunswick finds that AI adoption is spread across a wide range of practical use cases. Nearly six in 10 investors reported using AI most frequently to summarize financial news. Just over half, or 53%, use AI to search or synthesize information from SEC filings, while 50% use it to narrow down or answer specific investment questions.

Nearly half of respondents said they use AI to compare financial performance across firms and to draft investment memos or results summaries. Notably, 42% said they already use AI to conduct deep research on new investment ideas, putting idea generation among the more established AI-driven activities on Wall Street.

Across 14 potential applications tested in the survey, investors reported engaging AI in an average of six different use cases, underscoring how broadly the technology has been integrated into the research process.

At the same time, the data shows that trust and caution are developing in parallel. While usage rates are high, investors also expressed concerns about accuracy, bias and overreliance, particularly when using AI for tasks like updating financial models or assessing management tone and sentiment.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.