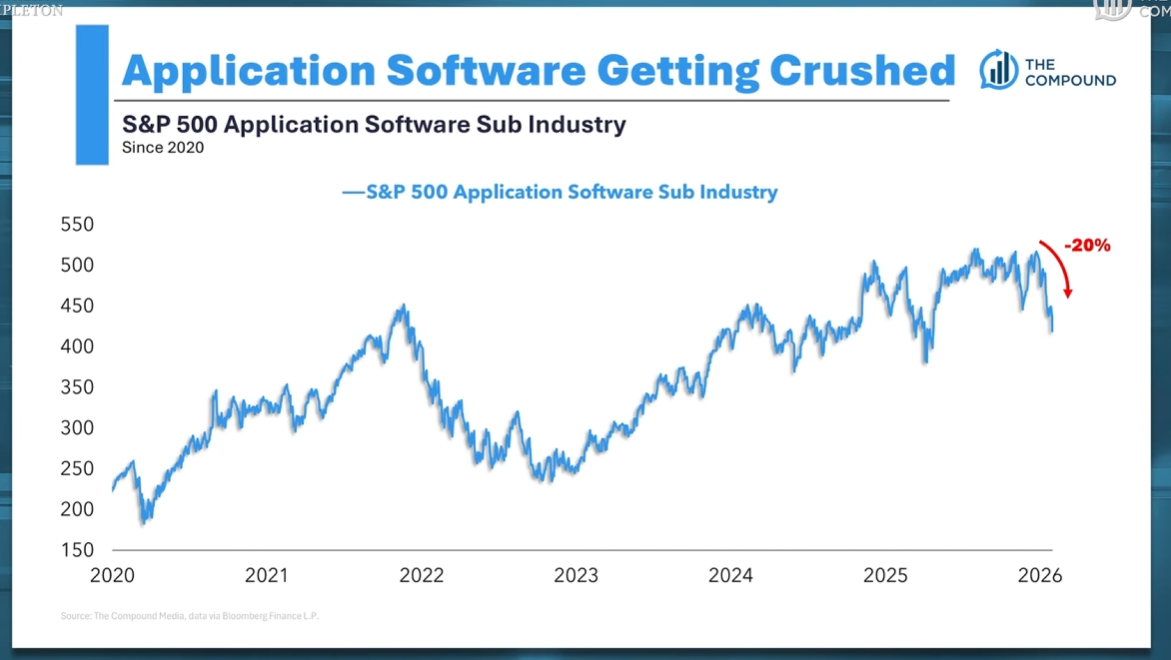

Fundstrat’s Tom Lee says AI has become a monster tailwind for one tech subsector, sparking a deep corrective move since the end of 2025.

In a new The Compound interview, the Wall Street veteran says the market appears to have chosen an early loser in the AI age.

According to Lee, the software application subsector looks incredibly weak as it continues to decline, whether good or bad news is released.

“Well, sometimes it’s easier to see the losers and not the winners. Usually it’s a signal, you know what I mean? So software, I think, is now being chosen as a loser because now AI can write code and replace a lot of subscription services. It’s washed out when you have bad news, and it doesn’t go down. But if you have bad news and it’s going down, that means…”

Looking at the chart shared by The Compound, the S&P 500 application software sub-industry is down over 20% in just a few months.

Turning to a potential market winner, Lee says he’s keeping a close watch on a potential SpaceX IPO this year. According to Lee, an IPO will open up distribution for early SpaceX investors, creating a massive liquidity event. While investors may not be able to immediately sell their shares, they could use their holdings as collateral to get loans or trade on margin, ultimately benefiting the US economy.

“SpaceX, when it goes public, is actually a huge, huge wealth creation event for many of the people who invested in SpaceX. I know some people who are seed [investors] in it, $50,000, and I think their stake’s worth $150 million because the company’s worth $1.5 trillion.

They might be able to get a margin, or they can use derivatives. Yeah, so think of it as like the alternative world who said, ‘No return.’ Suddenly, all these venture funds that are 99% of the fund’s value is SpaceX has a huge distribution. So all that money is going into the economy again.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.