A veteran Wall Street strategist says the S&P 500 is poised to reach record highs this year as the Fed turns its attention to a labor market being strained by AI.

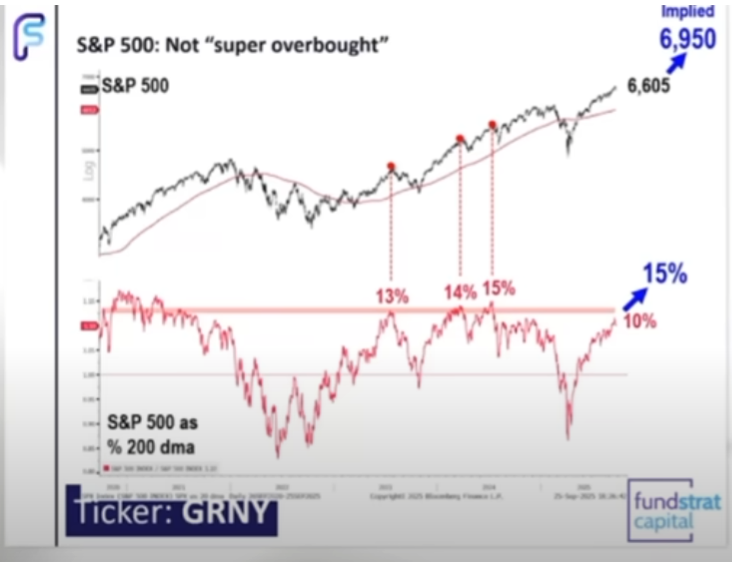

In a new video update, Fundstrat chief investment officer Tom Lee expects the S&P 500 to continue advancing into the fourth quarter, pointing to technical levels that suggest the index has room to run to the upside.

While stocks are oversold in the near term, he notes that broader market momentum remains intact.

“But the S&P 500 is still comfortably above the 20-day moving average, which is 6,602. And as you can see here, the last five times that we got near the 20-day, since the April lows, the market had a nice bounce. And that’s our belief, too, that in the short term, stocks are oversold.

And if you ask yourself, do we think the market is expensive now?

Keep in mind, the S&P is about 10% above its 200-day moving average. Now, is that expensive or overbought? Well, as we highlight here, since 2022, there are three times where the S&P was at a higher level relative to its 200-day moving average, 13 to 15%. And as we highlight here, those indeed marked local tops before the start of a larger correction.

So I think it’s better to think about the market as getting close to that, but it probably needs to gain another 5%, which would be 6,950. And that’s a lot of upside. And it coincides with the fourth-quarter rally.”

Looking at monetary policy, Lee says he believes that the Fed will likely stimulate the economy amid the labor market weakness, which he says is linked to AI.

“You may be wondering if the Fed is going to be hawkish, but keep in mind that AI is really raising questions about the labor market, and that’s what the Fed’s going to care about. St. Louis Fed did publish an interesting study, and they showed that if you look at AI exposure rate for industries, low to high, and then look at the rise in unemployment, low to high, you can see that it’s highly correlated. In other words, industries where there’s a lot of AI exposure are seeing the largest displacement of workers.

And so that ties into an observation, which is that we may be witnessing the early stages of AI-driven displacement. And that’s going to keep the Fed dovish.”

As of Monday’s close, the S&P 500 is trading at 6,661.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.