The hedge fund founded by billionaire Ray Dalio is unloading hundreds of millions of dollars in hyperscalers Alphabet (GOOGL) and Meta (META).

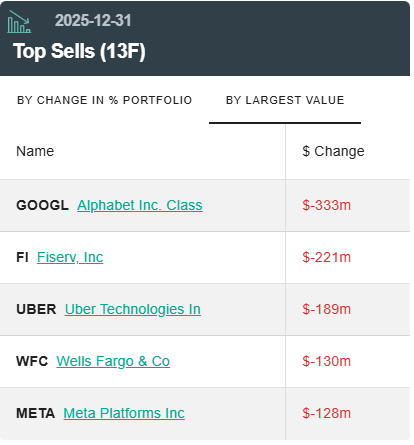

The latest 13F filing of Bridgewater Associates shows that the asset manager unloaded $333 million in Alphabet shares in Q4 of 2025, reducing its GOOGL holdings by 40%.

During the quarter, Bridgewater sold 1,063,070 GOOGL shares, bringing down its total shares to 1,590,826 valued at $497.928 million.

In Q3, Google was Bridgewater’s single-largest AI exposure, controlling 2,650,000 shares.

Bridgewater also dumped $128 million worth of META last quarter, cutting its holdings by a whopping 46%. Data shows the firm distributed 193,218 META shares, reducing its total shares to 223,701, worth $147.662 million.

While the firm sold massive stakes in Google and Meta, it aggressively accumulated Oracle (ORCL), Micron (MU) and Nvidia (NVDA) last quarter.

The filing shows Bridgewater bought $286 million worth of ORCL shares, boosting its stake by 361% in just three months. The company now holds 1,873,481 shares in Oracle valued at $365.160 million.

The firm also bought $253 million worth of Micron shares last quarter, taking its MU position from just 1,696 shares in Q3 to 889,640 shares in Q4 – an astronomical 52,355% increase. Bridgewater now holds $253.912 million worth of MU shares.

And Bridgewater accumulated $253 million in Nvidia shares in Q4, boosting its position in the world’s most valuable company by 54%. Ray Dalio’s asset manager now controls 3,865,205 NVDA shares valued at $720.860 million.

As of Q4 2025, Bridgewater oversees $27.4 billion in assets.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.