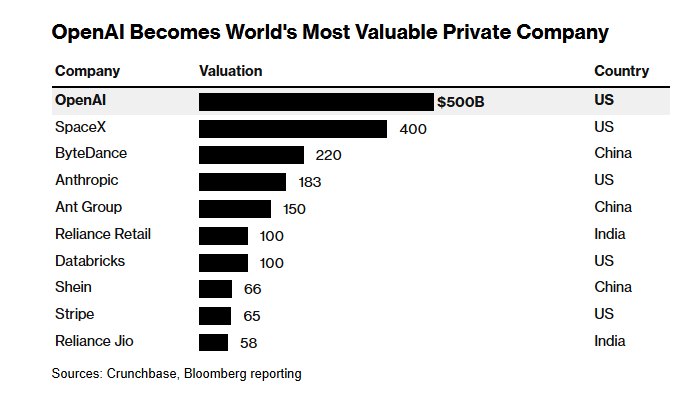

OpenAI has reached a valuation of $500 billion in a deal that allows current and former employees to cash out shares, vaulting the ChatGPT maker past Elon Musk’s SpaceX.

OpenAI staff sold about $6.6 billion worth of stock to investors, including Thrive Capital, SoftBank, Dragoneer, Abu Dhabi’s MGX, and T. Rowe Price, reports Bloomberg.

The sale boosts OpenAI’s price tag far above the $300 billion level it commanded earlier this year in a SoftBank-led round. The milestone underscores the frenzy surrounding companies driving artificial intelligence, a sector investors believe could transform entire economies.

The deal comes as Sam Altman’s company negotiates with Microsoft to convert into a public benefit corporation under the control of its existing nonprofit. Founded in 2015, OpenAI was initially structured as a nonprofit with a mission to advance digital intelligence for humanity’s benefit.

“OpenAI’s planned evolution will see the existing OpenAI nonprofit both control a Public Benefit Corporation (PBC) and share directly in its success. OpenAI started as a nonprofit, remains one today, and will continue to be one—with the nonprofit holding the authority that guides our future.”

Both Altman and Musk, who co-founded OpenAI, have publicly warned of existential risks posed by AI. Their split has turned litigious, with Musk suing OpenAI for allegedly abandoning its founding purpose when it accepted billions in backing from Microsoft.

Despite its soaring valuation, OpenAI has yet to post a profit. But the firm has been a central player in the AI infrastructure boom, cutting large-scale cloud and chip deals with Oracle and SK Hynix.

The secondary sale may also help retain talent. Meta has reportedly tried to lure researchers with pay packages in the nine-figure range, and OpenAI has turned to secondary sales to provide liquidity and reduce turnover.

Altman’s company continues to push out new products at speed, from open-source models to its flagship GPT-5 release in August. The valuation milestone arrives as competition heats up with Google and Anthropic, both racing to raise fresh capital for their own AI ventures.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.