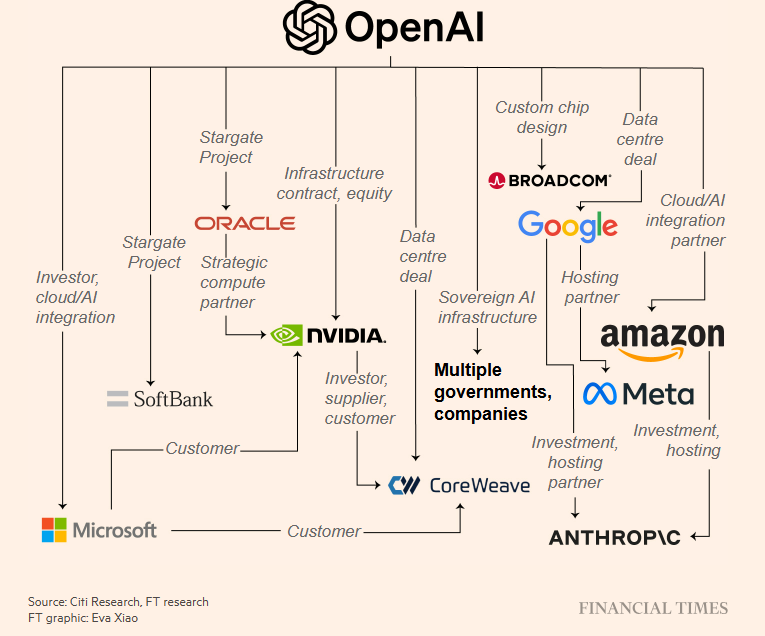

OpenAI has signed more than $1 trillion worth of compute and infrastructure deals this year — an unprecedented bet on artificial intelligence that has pulled some of the world’s largest chip and cloud firms into its orbit.

The startup’s latest pact with AMD adds to prior tie-ups with Nvidia, Oracle, and CoreWeave, cementing its position at the center of the AI supply chain, reports The Financial Times.

But the scale of these agreements — equal to roughly 20 gigawatts of power or 20 nuclear reactors — has raised questions about how OpenAI can sustain the spending.

Analysts say each gigawatt of AI computing capacity now costs around $50 billion to deploy, putting the total bill near $1 trillion. The figure dwarfs OpenAI’s revenue and underscores how dependent it has become on suppliers willing to accept complex, circular arrangements and delayed returns.

Gil Luria of DA Davidson offers a blunt assessment of the risk.

“OpenAI is in no position to make any of these commitments. Part of Silicon Valley’s ‘fake it until you make it’ ethos is to get people to have skin in the game. Now a lot of big companies have a lot of skin in the game on OpenAI.”

Those counterparties are some of the biggest names in technology. Nvidia, now valued above $4 trillion, plans to invest $100 billion in OpenAI over the next decade. AMD structured its deal to include warrants letting OpenAI buy up to 10% of its stock for a cent a share if milestones are hit.

Says AMD chief executive Lisa Su,

“It’s a pretty innovative structure, which didn’t come lightly.”

The financing arrangements have already lifted markets. AMD shares surged almost 24% after announcing the deal, while Oracle’s market capitalization jumped $244 billion following its own partnership disclosure last month. Each partner benefits from OpenAI’s liquidity while extending it more credit to purchase their chips or lease their capacity.

For chief executive Sam Altman, profitability remains a distant concern. He says becoming profitable was “not in my top-10 concerns.”

“But obviously someday we have to be very profitable, and we’re confident and patient that we will get there. Right now we are in a phase of investment and growth and if we can deliver all of this value.”

Earlier this week, OpenAI president Greg Brockman said the company is examining every financing avenue available as it pushes to scale faster than competitors.

“Now, as a company that is trying to move as fast as we can, we look at everything. We look at equity, debt. We look at trying to find creative ways of financing all of this.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.