Corporate America’s massive bet on AI is facing growing skepticism from within, according to a new survey.

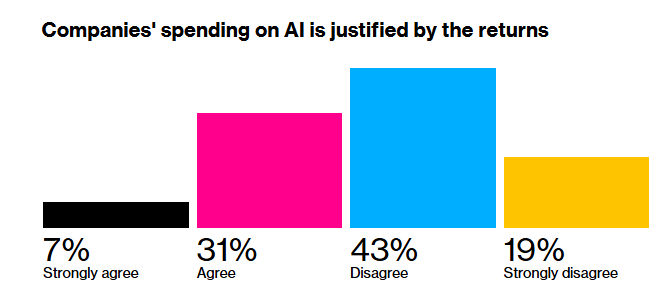

The latest Markets Pulse survey reveals that 62% of respondents disagree or strongly disagree that companies’ AI spending is justified by the returns, reports Bloomberg.

The poll of 149 market participants, conducted between September 29 and October 8, captures rising doubts after a year of record-breaking AI-driven stock gains.

The survey shows just 7% strongly agree and 31% agree that AI spending is warranted, while 43% disagree and 19% strongly disagree—a near-even split that highlights waning confidence in the technology’s near-term payoff.

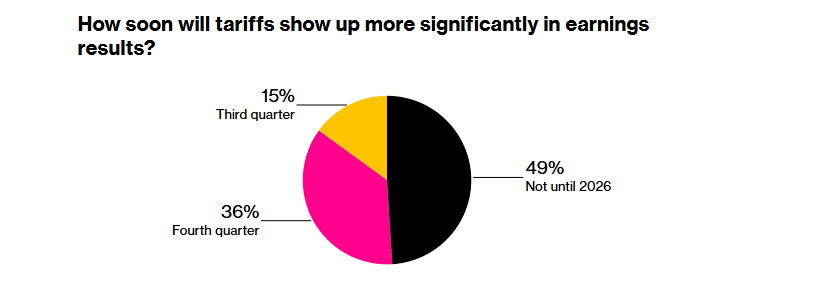

Meanwhile, the survey also shows that about half of the survey respondents believe Trump’s tariffs will impact earnings in 2026. More than a third say they expect tariffs to hit earnings this quarter, while 15% believe tariffs have been priced in since Q3 of this year.

On Friday, the S&P 500 slumped more than 2% after President Donald Trump imposed an additional 100% tariffs on China. Trump said the move is a retaliatory measure after China imposed export controls on “virtually every product they make.”

“It has just been learned that China has taken an extraordinarily aggressive position on Trade in sending an extremely hostile letter to the World, stating that they were going to, effective November 1st, 2025, impose large scale Export Controls on virtually every product they make, and some not even made by them. This affects ALL Countries, without exception, and was obviously a plan devised by them years ago. It is absolutely unheard of in International Trade, and a moral disgrace in dealing with other Nations.

Based on the fact that China has taken this unprecedented position, and speaking only for the U.S.A., and not other Nations who were similarly threatened, starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China), the United States of America will impose a Tariff of 100% on China, over and above any Tariff that they are currently paying. Also on November 1st, we will impose Export Controls on any and all critical software.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.