Michael Burry is escalating his criticism of Tesla, noting that its valuation rests on ideas that destroy shareholder value rather than create it.

In a series of posts on X, the investor behind “The Big Short” attacks Tesla’s humanoid robot ambitions and links the company’s long-term outlook to dilution-driven erosion of present value.

Burry says Tesla’s long-term narrative related to its Optimus project is unrealistic and disconnected from economic constraints.

“Humanoid robots are a vanity project, an inexplicably stupid idea. We need robots that do things humanoids cannot, not a neo-Aryan army. The future of Tesla is an army of humanoid robots that Elon Musk says could eliminate poverty and the need for work.”

Looking at Tesla’s valuations, Burry says the electric vehicle maker’s current market cap cannot be justified, as the firm continues to issue additional stocks.

“Tesla is ridiculously overvalued…Tesla dilutes its shareholders at about 3.6% per year, with no buybacks.”

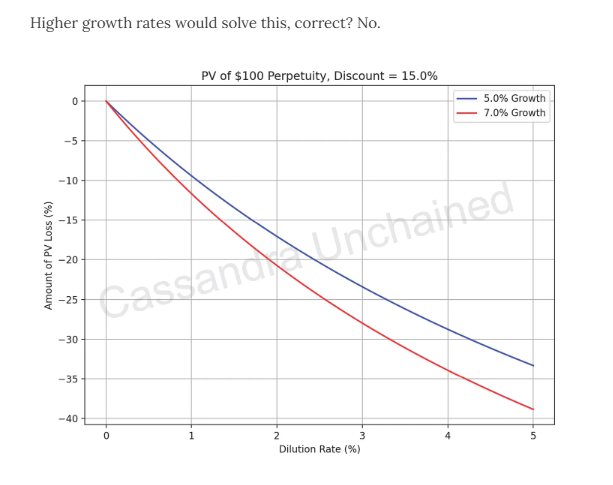

To illustrate the damage, Burry points to the mathematics of present value under persistent dilution, while noting that dilution will likely ramp amid Musk’s new pay package.

“The chart [below] shows the kind of present value (PV) destruction that this level of destruction can impart. With recent news of Elon Musk’s $1 trillion pay package, the dilution is certain to continue.”

Burry’s chart appears to suggest that about 3.6% dilution, roughly 25% to 30% of shareholder value is destroyed. Higher growth rates only slow the damage, but do not reverse it.

Burry reiterates his core valuation claim, while clarifying his positioning.

“Tesla’s market capitalization is ridiculously overvalued today and has been for a long time… I am not short.”

Burry’s comments indicate Tesla’s humanoid robot push is a capital-intensive bet that, when paired with ongoing dilution, risks long-term value erosion even if growth narratives persist.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.