Michael Burry is taking direct aim at the money flows powering the AI boom, with Sam Altman’s OpenAI as the center of his target.

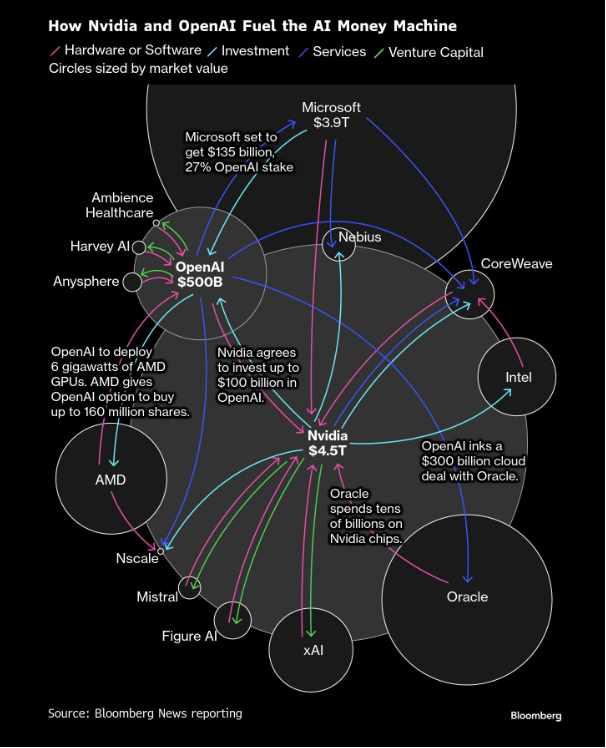

In a fresh commentary on X, the “Big Short” investor says a widely circulated Bloomberg chart showing Nvidia, OpenAI and hyperscalers locked in a multi-billion dollar loop reveals something darker than a self-reinforcing business ecosystem.

“Every company listed below has suspicious revenue recognition. The actual chart with ALL the give-and-take deals would be unreadable. The future will regard this as a picture of fraud, not a flywheel.”

He notes that customer demand remains weak despite soaring valuations and record capital spending, with OpenAI at the center of the illusion and the single point of failure.

“True end demand is ridiculously small. Almost all customers are funded by their dealers… One more. OpenAI is the linchpin here.”

Burry also hints that without clear and credible financial oversight, investors may be relying on wishful accounting rather than proven economics.

“If you can name OpenAI’s auditor in 1 hour, you win some pride.”

OpenAI grabbed headlines earlier this month after CFO Sarah Friar floated the idea that the ChatGPT creator was hoping the federal government would help guarantee financing for chips tied to its data-center buildout. CEO Sam Altman subsequently clarified the statement, saying that the federal government should not use taxpayer money to rescue struggling private companies.

JPMorgan recently came out with estimates that the AI buildout will drain $1.5 trillion from the bond market in the next five years.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.