Banking giant JPMorgan Chase believes that the rapid pace of investment in the artificial intelligence space will not let up anytime soon.

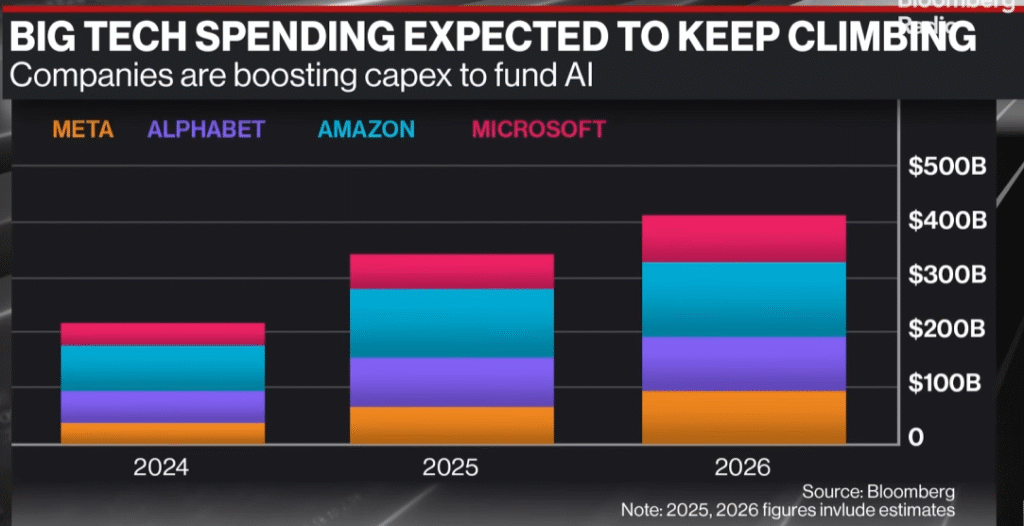

Data from Bloomberg shows that the four largest hyperscalers – Meta, Alphabet, Amazon and Microsoft – are poised to allocate more than $400 billion in AI capital expenditure (CapEx) in 2026.

The figure represents nearly 100% of what the four tech giants invested in AI just last year.

In a new Bloomberg interview, Grace Peters, co-head of Global Investment Strategy at JPMorgan, says the swelling spending wave is sustainable and AI stock valuations are justified. She also notes that next year, the AI buildout will begin to benefit names and sectors beyond the Magnificent 7.

“I would focus on the sort of the broadening out theme as being one of the key facets of our outlook. This year, we’ve had technology and financials as two key sectors. And for next year, we’re also adding industrials, utilities and healthcare as well, which speaks to that broadening out theme. Now, some of this is related to digital transformation, because we’re not just talking about hyperscalers and AI, where obviously hyperscalers have been the main beneficiaries of the buildout so far. And we think that can continue. Earnings growth from that group will continue at least for the next 12 months, I think, to be significantly ahead of the market.”

Peters adds that power generation will be crucial in the AI push, giving two more sectors a shot in the arm.

“But we must also think about the power needs of which utilities come in, and further infrastructure needs where industrials come in. And so I think all of these sectors should be contributing to that 11% earnings growth that I mentioned for next year.”

All in all, Peters expects the S&P 500 to surge to 7,300 next year, fueled by AI spending.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.