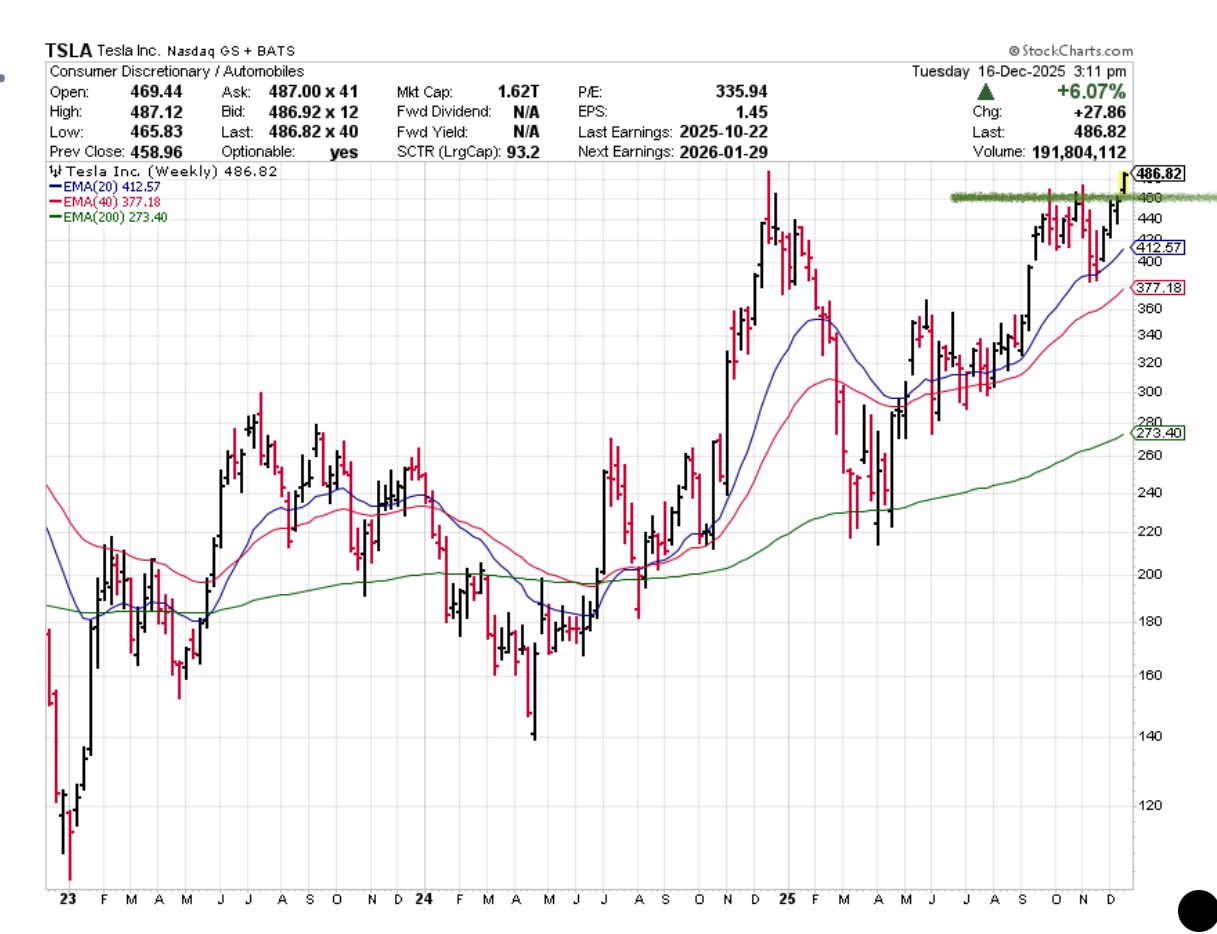

A prominent market analyst says Tesla (TSLA) is now pushing into uncharted territory in a move that reflects a decisive technical breakout years in the making.

In a new post on X, Wellington-Altus’s top strategist, James Thorne, says Tesla has completed a major breakout pattern after years of consolidation, noting that it’s nothing but blue skies for the stock of the electric vehicle maker.

“Long-term investors are rewarded.

Triple top breakout.

Don’t bet against Elon.

TSLA.”

On Tuesday, TSLA exploded to a new all-time high of $491.50 before closing the trading session at $489.88. The triple top breakout suggests that TSLA is free to climb to fresh record levels with no technical resistance in sight.

Fellow market analyst Mark Newton echoes the sentiment. According to Fundstrat’s global head of technical strategy, TSLA’s rally looks legitimate as it is paired with strong volume, following a four-year base-building phase.

“Most won’t take the time to look at Weekly charts which show base building since 2021, but important that this bullish pattern from 12/17/24 peaks will have made a roundtrip to the same exact level in one-year’s time. While US markets might require another couple days given recent consolidation, TSLA has taken the lead in being the first of the “Mag 7″ to make new 2025 highs today & volume is extremely supportive.”

In November, Elon Musk said that Tesla will no longer be just a robotics and electric vehicle firm, as it is now gearing up to ship more AI chips than Nvidia, AMD and everyone else combined.

“We expect to build chips at higher volumes ultimately than all other AI chips combined. Read that sentence again, as I’m not kidding.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.