US banks are rapidly rolling out or expanding their use of AI as fraud losses surge to historic levels.

A new study from Cornerstone Advisors polled 416 respondents working at banks and credit unions across the country, including C-level executives.

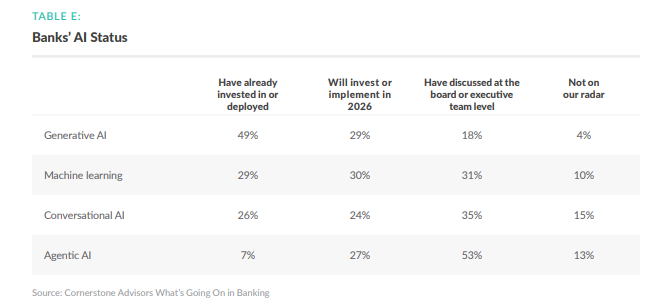

The survey finds that AI adoption among US banks is in full swing. Generative AI is already the most widely deployed AI technology in banking, with 49% of banks reporting active use. Another 29% say they will invest or implement generative AI in 2026, leaving just 4% saying it is not on their radar.

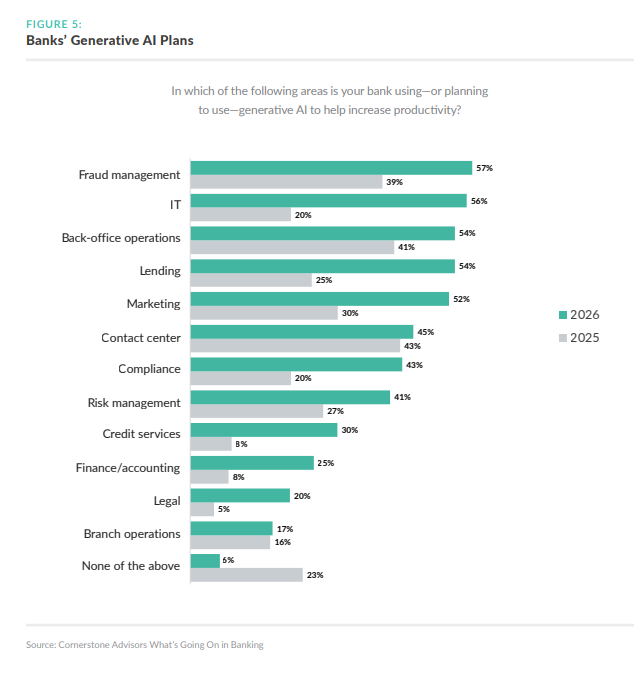

Turning to the use cases of AI inside banks, Cornerstone says fraud management is driving adoption, with 57% of banks saying they are using or planning to use generative AI for fraud prevention in 2026, up from 39% in 2025.

IT operations, back-office processing, and lending follow closely, each with adoption rates above 50% this year. Banks are also applying generative AI to compliance, risk management and contact centers, reflecting a shift toward AI-assisted monitoring, faster investigations and real-time detection across the institution. Meanwhile, credit services, finance and legal functions remain earlier in the adoption curve but are showing steady growth.

Cornerstone’s findings come as data from the FBI showed that fraud losses have reached $16 billion, a 33% increase from 2023. Banking giant JPMorgan Chase warned in December that scammers are using AI to masquerade as bank executives, government officials and family members, matching emotional tone and urgency to push victims into quick decisions.

Just last week, Visa warned that AI-driven fraud could supercharge cybercrime losses to a staggering $16 trillion across the globe by 2029.

Cornerstone Advisors is a Pennsylvania-based management and technology firm, specializing in the banking and fintech sectors.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.