Circle CEO Jeremy Allaire says the next phase of AI evolution would force a fundamental rewrite of how money moves across the world.

In a recent interview, Allaire says the rise of autonomous AI agents is pushing blockchain and payments infrastructure toward a breaking point.

According to Allaire, AI agents will swarm the digital world, and they’ll need a new payment system to conduct nonstop economic activity.

“The next generation of blockchain networks, things like Arc, which Circle’s building on, there are other new blockchain networks, are actually being designed specifically for agentic compute. They’re designed specifically for the financial and economic activity of a world where, three years, five years from now, one, I think, can reasonably expect that there will be billions, literally billions of AI agents conducting economic activity in the world on a continuous basis.

They need an economic system. They need a financial system. They need a payment system. There is no other alternative, in my view, other than stablecoins to do that right now.”

Circle’s Arc is a layer-1 blockchain designed to settle stablecoin transactions across the globe.

“It’s built for a world where:

→ Financial apps are as accessible as email

→ Dollars, euros, pesos, and other fiat currencies move instantly

→ Private transactions that support compliance happen at scale

→ AI agents transact and coordinate commercial activity autonomously.”

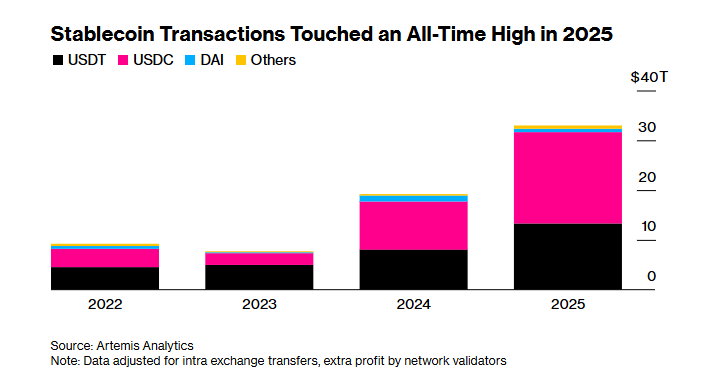

In 2025, stablecoin transaction volumes exploded to $33 trillion and are expected to climb to $56 trillion by 2030.

The figure will likely be dramatically higher as AI agents adopt the fiat-currency-pegged crypto asset to pay for goods and services online.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.