One of Wall Street’s most closely followed strategy outlooks is raising a red flag focused on OpenAI and the physical limits behind the artificial intelligence boom.

In its 2026 Eye on the Market outlook, JPMorgan Asset & Wealth Management chairman of market and investment strategy Michael Cembalest warns that energy supply, not capital or chips, may become the binding constraint for AI, with OpenAI at the center of the risk.

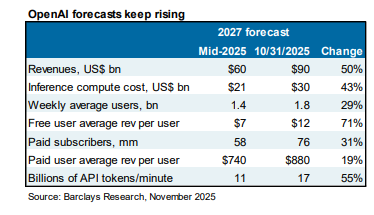

Cembalest points to OpenAI’s own internal forecasts, which have been revised sharply higher in a matter of months, implying extraordinary infrastructure requirements just to stay on its current growth path.

“By some accounts, OpenAI is 6-12 months ahead of competitors based on user growth, monetization and model/product capabilities. The first table shows how OpenAI’s forecasts for 2027 that the company made in mid-2025 were already eclipsed by forecasts for 2027 that it made just three months later. If OpenAI stays on its current trajectory, the company projects it will still need more compute for training than for inference through to 2030.”

To meet those projections, he says OpenAI’s power needs alone would dwarf recent US electricity additions.

“For these forecasts to materialize, OpenAI would need 30 GW of new generation capacity by 2030.”

Cembalest contrasts that requirement with the realities of the US power system.

“The entire US added just 25 GW in 2024 after adjusting for the intermittency and reliability of new capacity.”

He notes that delays across multiple energy sources make closing that gap extremely difficult.

“Given combined cycle turbine delays, grid interconnection bottlenecks, wildly overly optimistic timetables for small modular reactors and nuclear fusion and limited opportunities to recommission shuttered but still viable nuclear fission plants, energy may be a significant constraint on AI.”

Amid the energy constraints, the JPMorgan strategist calls OpenAI a systemic risk to the broader AI narrative.

“OpenAI is arguably the biggest individual corporate risk to the whole AI story, even more than Nvidia and despite OpenAI being a private company. OpenAI is on track to make $10-$20 bn in revenue and has commitments of $1.4 trillion to its corporate partners, and currently survives on subscription/developer AI fees with limited or zero search/advertising revenue, cloud computing revenue or hardware sales… Meanwhile, OpenAI’s own chief economist disclosed that 72% of GPT queries are not business-related.”

Cembalest highlights that OpenAI’s infrastructure limit is not just to energy.

“A power draw of 30.5 GW would also require around 300% of Nvidia’s 2025 GPU shipments and more than 100% of current global high bandwidth memory supply.”

According to Cembalest, the next year to year and a half will test whether the AI industry can reconcile its explosive growth expectations with the physical limits of power generation and grid infrastructure.

“The next 12-18 months will be very interesting.”

Last month, Sam Altman said OpenAI is “on a very steep growth curve of revenue,” but is facing constant compute shortages, stifling the firm’s ability to grow faster.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.