JPMorgan says the artificial intelligence boom is entering a more complex stage, with powerful fundamentals supporting the theme even as the market grows more sensitive to potential setbacks.

In the bank’s 2026 Year-Ahead Investment Outlook: AI Lift and Economic Drift, JPMorgan highlights that today’s AI boom is different from past investment cycles.

According to the banking giant, the hundreds of billions in AI capital expenditures (CapEx) are largely funded by Big Tech’s large cash stockpile.

“Unlike past episodes of speculative excess, today’s AI cycle is being largely financed by profitable, cash-rich firms and underpinned by robust demand. The tech sector’s free cash flow margin, near 20%, is more than double its late 1990s level, underscoring both robust profitability and the capacity to self-fund AI investment.”

JPMorgan also says capital spending is flowing into real products and services rather than unsustainable hype. But the bank notes that investors are finding it difficult to grasp both the scale of technological advancement and CapEx.

“AI spending is also translating into monetized demand for AI hardware, cloud services and software, helping justify continued investment. Indeed, bubbles burst into nothing, but the AI theme is building real infrastructure to meet growing demand. Still, markets are struggling to price a technology that is advancing at exponential speed. Earnings growth has been extraordinary, but expectations have risen even more so.”

Turning to potential risks, the bank says that AI-linked names are the major drivers of market growth. JPMorgan warns that the concentration of growth creates vulnerabilities that could drag down the entire stock market.

“Tech sectors have accounted for 36% of S&P 500 earnings and 56% of the index’s capital spending growth over the last 12 months, leaving markets vulnerable to any missteps, such as a slowdown in business adoption, power constraints or faster-than-expected hardware obsolescence.”

Overall, JPMorgan believes that the AI trade is not in a bubble.

“The stakes are high, and visibility into the ultimate winners limited, but this looks less like a bubble and more like the tumultuous beginnings of a structural transition.”

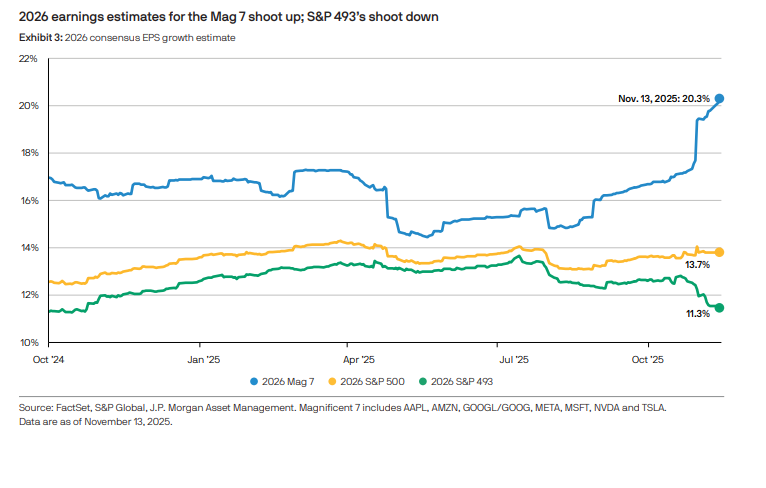

The bank also predicts that Mag 7 names will outrun other companies in the S&P 500 in terms of earnings next year. JPMorgan predicts earnings estimates for the Mag7 will shoot up to 20.3% next year, while the S&P 493 will grow at about 11.3%.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.