Banking titan JPMorgan Chase says artificial intelligence could deliver annual productivity gains large enough to offset the US government’s budget shortfall.

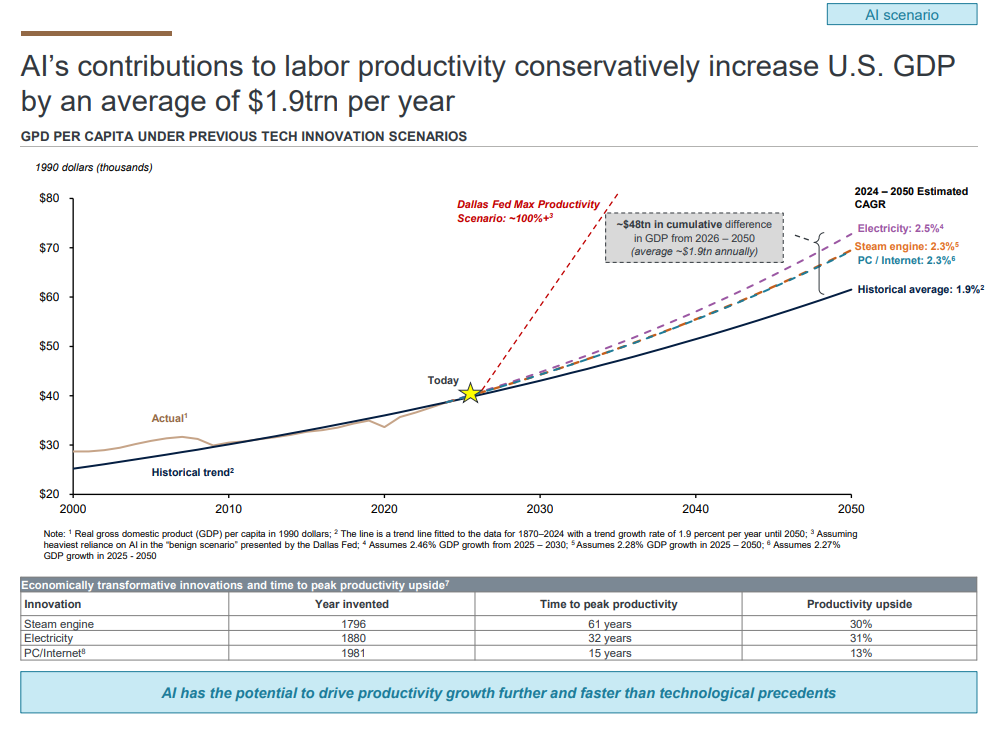

In its Navigating the Future report, the largest bank in the US projects AI’s contributions to labor productivity will “conservatively” boost US GDP by an average of $1.9 trillion per year.

It compares AI’s potential trajectory to past industrial revolutions. Steam engines lifted productivity growth by 30% in 61 years. Electricity boosted output by 31% within 32 years. PCs and the internet raised productivity by 13% in 15 years. JPMorgan says “AI has the potential to drive productivity growth further and faster than technological precedents.”

JPMorgan predicts that the AI boom would cumulatively add $48 trillion to the US economy from 2026 to 2050.

The scale of AI-driven growth could be transformative, leading to productivity gains that could erase the country’s budget deficit. The Congressional Budget Office (CBO) estimates the federal deficit at $1.9 trillion in fiscal 2025, widening to $2.7 trillion by 2035. Amid the swelling budget deficit, the CBO projects that federal debt soars from 100% of GDP this year to 118% in 2035, shattering its previous high of 106% of GDP in 1946.

But JPMorgan also sees a scenario where AI could contribute a lot more to the US economy. In JPMorgan’s interpretation of a Dallas Fed max productivity model, the bank envisions AI delivering “~100%+” upside relative to historical growth, ultimately raising the US per capita GDP from $66,700 today to $80,000 by the 2030s.

While JPMorgan Chase appears to suggest that AI has the capacity to wipe out or offset most of the country’s budget deficit, others are not so sure. The nonprofit public policy research organization Brookings Institution states that “the impact of AI on federal spending and revenues is highly uncertain, given the technology’s nascent evolution and unpredictable economic effects.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.