Banking titan JPMorgan Chase is massively trimming its exposure in the AI trade, dumping billions of dollars worth of Mag 7 names.

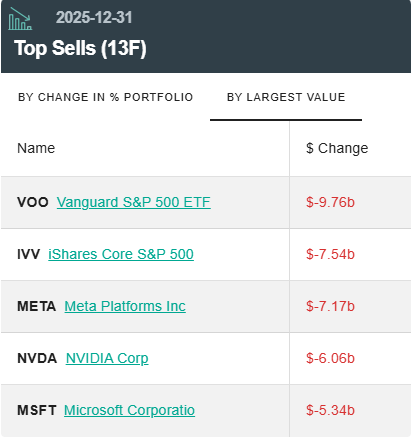

The bank’s Q4 13F filing shows that JPMorgan unloaded $7.16 billion in shares of the social media giant Meta (META), selling 10,859,259 shares to reduce its holdings by 20% in just one quarter.

As of the end of Q4, the bank holds 43,855,509 shares in META worth about $28.948 billion.

Aside from META, JPMorgan also sold $6.06 billion in Nvidia (NVDA), distributing 32,478,144 shares in Q4 to trim its exposure in the chipmaker by 7%. At quarter end, JPMorgan Chase owns 456,141,138 Nvidia shares valued at $85.070 billion.

And JPMorgan unloaded $5.34 billion in Microsoft (MSFT), dumping 11,048,048 shares to cut its holdings by 7%. As of December 31st, 2025, the bank holds 147,759,850 MSFT shares, worth about $71.459 billion.

In total, the bank sold $18.570 billion worth of shares across the three Big Tech names.

Looking closer at the filing, JPMorgan also cut its holdings in the other Mag 7 names last quarter. Data shows that it sold 11,236,420 Apple (AAPL) shares, bringing its holdings down to 225,419,111 shares valued at $61.282 billion.

The bank trimmed its exposure in Amazon as well, selling 22,614,647 AMZN shares and reducing its ownership to 160,046,290 shares, worth about $36.941 billion.

Alphabet was also caught in the portfolio shift as the bank sold 5,239,152 GOOGL shares to slash its exposure to 64,654,741 shares valued at $20.236 billion.

And JPMorgan dumped 47,889 Tesla (TSLA) shares in Q4, trimming its holdings to 44,591,616 shares worth $20.053 billion.

Despite the Q4 sell-off across Mag 7 names, Nvidia, Microsoft, Apple and Amazon represent JPMorgan’s largest holdings, accounting for 16% of the bank’s $1.6 trillion portfolio.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.