The famed short seller who built his career exposing bubbles and fraud says today’s artificial intelligence (AI) frenzy is starting to look like the last great tech overbuild.

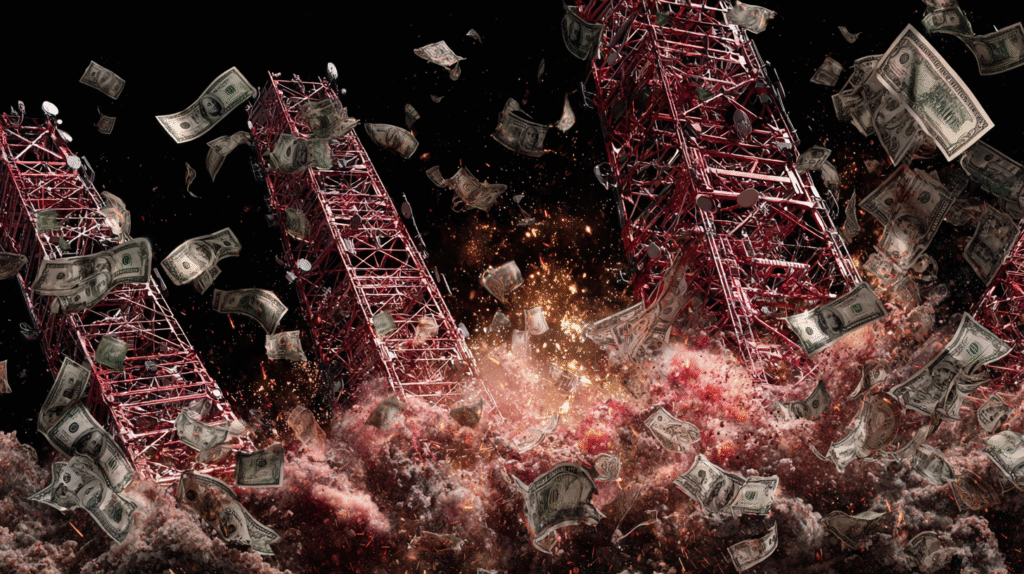

In a new interview with the Institute for New Economic Thinking, Jim Chanos points to the pace of capital spending by US tech giants on chips and data centers, comparing it to the telecom and dotcom mania of the late 1990s.

Chanos says the Mag 7 firms are spending heavily to buy chips and build out data centers, and firms like Nvidia are raking in profits, a scenario that he witnessed about 25 years ago.

“What we’re seeing now with AI chips is similar to what happened during the telecom boom… The companies selling the chips book that spending as revenue and profit, just like Lucent and Nortel did back then. But the companies doing the spending — like MCI or AT&T in the past — are the ones taking on the cost. They capitalize those expenses and spread the write-off over several years. So, a chip that might become obsolete in just two years is being depreciated by some of the big hyperscalers over five, six, or even seven years. That creates a huge boost to corporate earnings during tech buildout booms like the one we’re seeing now.”

But the billionaire warns that the companies doing the spending must see a return on their investment. Otherwise, the spending will stop, leading to an earnings collapse.

“I’m starting to worry there’s so much spending right now on the AI physical boom — the buildout of data centers, chips, and so on — that if anyone decides to pause and ask, ‘What’s our real economic return here?’ it could be a big problem. It’s one thing when we’re spending $50 billion a year; it’s another when that changes. As a group, we’re spending $500 billion a year, and if there’s no real return, can we really spend a trillion dollars a year on this without seeing results…?

So we’re getting to the point now where within a year or two, some of these large companies are going to start having to make some very uncomfortable decisions as to when and how they will monetize AI, and what the returns will ultimately be on this massive spending, because the chips basically depreciate over two years.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.