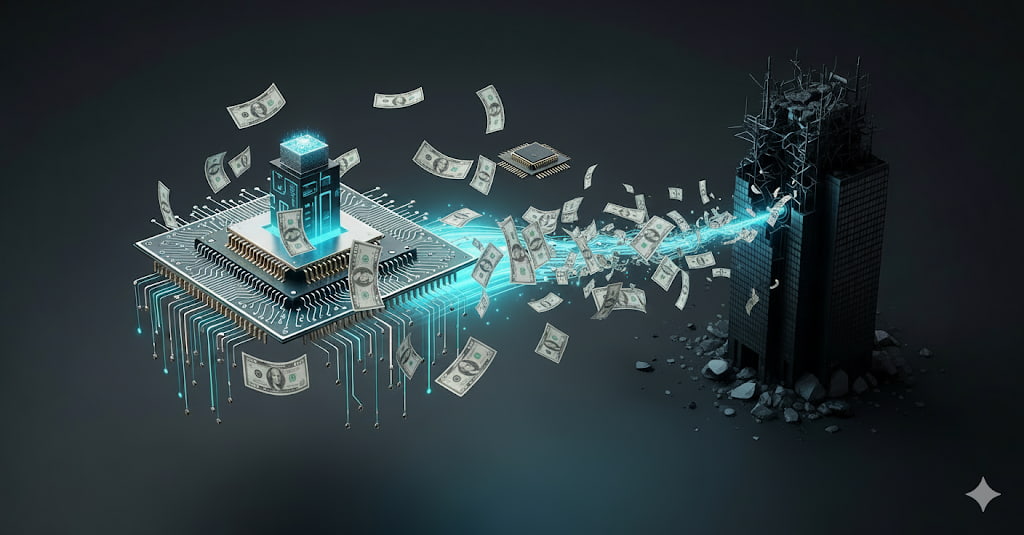

Nvidia is making a multi-billion-dollar bet on its longtime rival, striking a deal with Intel to co-develop new chips for PCs and data centers in one of the most unexpected alliances in Silicon Valley.

In a new press release, Nvidia says it will invest $5 billion in Intel stock at $23.28 a share, pending regulatory approval.

News of the massive investment sent shares of INTC skyrocketing to as high as $33, printing gains of over 30%.

The deal also gives Intel a much-needed financial boost as it struggles with market share losses and heavy spending demands, while offering Nvidia new ways to embed its technology across the x86 ecosystem.

For data centers, Intel will design Nvidia-custom x86 CPUs that will be integrated directly into Nvidia’s AI infrastructure platforms. Those systems will then be offered as complete products to the market. For personal computing, Intel will build x86 system-on-chips that incorporate Nvidia RTX GPU chiplets. The companies say the new x86 RTX SoCs will serve PC markets that demand tighter integration of CPUs and GPUs.

The companies say the partnership will deliver “multiple generations” of products across hyperscale, enterprise, and consumer markets.

Says Nvidia CEO Jensen Huang.

“This historic collaboration tightly couples NVIDIA’s AI and accelerated computing stack with Intel’s CPUs and the vast x86 ecosystem — a fusion of two world-class platforms. Together, we will expand our ecosystems and lay the foundation for the next era of computing.”

The move sets the stage for today’s lifeline from Nvidia. In August, the US government grabbed nearly 10% of Intel. Weeks later, SoftBank poured in $2 billion. The chipmaker has since been offloading assets to bankroll its costly bid for leading-edge manufacturing.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.