Alphabet (GOOGL) just exploded to a fresh all-time high following news that Google delivered a record-breaking revenue quarter.

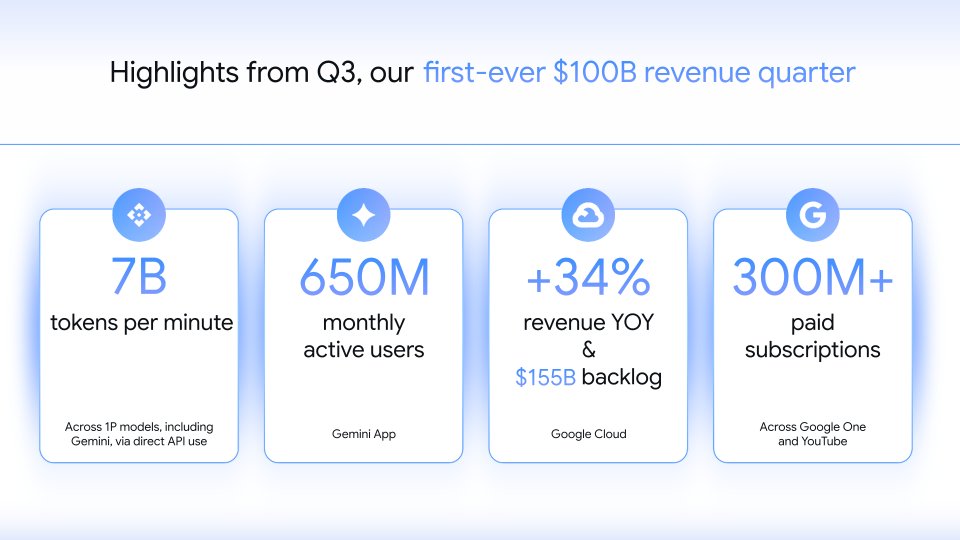

In its latest earnings report, CEO Sundar Pichai says the firm posted its “first-ever” $100 billion revenue quarter in Q3, representing a 100% rise from the figures delivered in 2020.

According to Pichai, Google’s momentum is strong as it rides a surge in AI-enhanced search usage, cloud demand and a swelling base of subscription customers as the Gemini platform scales across products and geographies.

“Our first-party models, like Gemini, now process 7 billion tokens per minute, via direct API use by our customers. The Gemini app now has over 650 million monthly active users, and queries increased by 3x from Q2. Cloud had another great quarter of accelerating growth with AI revenue as a key driver. Cloud backlog grew 46% quarter over quarter [to] $155 billion. And we crossed 300 million paid subscriptions, led by growth in Google One and YouTube Premium.”

Pichai also highlights that AI-powered search adoption is rising as users gravitate toward new query modes and interactive agents.

“As we’ve shared before, AI Overviews drive meaningful query growth. This effect was even stronger in Q3, as users continue to learn that Google can answer more of their questions. We are also seeing that AI Mode is resonating well with users. In the US, we’ve seen strong and consistent week-over-week growth in usage since launch and queries doubled over the quarter.”

News of Alphabet’s record-shattering quarter sent GOOGL flying to a new all-time high at $275. The stock is now up 44% since it opened the year at $190.

Fundstrat technical analyst Mark Newton recently said that momentum is the name of the game and that investors should focus more on stocks trading at all-time highs.

“Investors always try to buy dips. That’s not the way you want to approach it. You want to stick with momentum. Momentum has been the number one factor over the last 20 years in the stock market. You have to stick with what’s working and continue to add on strength.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.