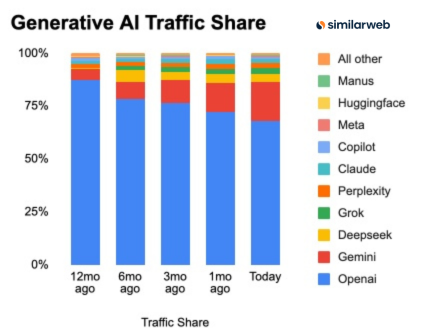

The gen AI market is moving away from single-platform dominance as user traffic fragments across a growing field of competitors.

New data from Similarweb shows that twelve months ago, ChatGPT accounted for 87.2% of global generative AI website traffic, effectively operating as a near-monopoly.

As of December 5, that share has fallen to 68.0%, marking a decisive shift toward a multi-platform ecosystem.

The most notable gainer over that period has been Gemini, which has grown from 5.4% of traffic a year ago to 18.2% today, approaching the psychologically important 20% threshold. The acceleration has been steady, with Gemini’s share rising from 7.9% six months ago to 13.7% just in November.

Other challengers are also showing incremental gains. Grok has seen its traffic share climb steadily over the past year, rising from 2.1% six months ago to 2.9% today, while maintaining consistent month-to-month momentum.

Meanwhile, other platforms have held relatively stable positions. Perplexity, Claude, and Copilot each remain clustered in the 1% to 2% range, suggesting a long tail of usage rather than rapid consolidation.

The data shows that ChatGPT’s decline has not been driven by a single rival, but by the cumulative effect of multiple platforms gaining relevance at the same time. Over the last three months alone, ChatGPT’s share fell from 76.4% to 68.0%, while Gemini, Grok, and other competitors absorbed the difference.

“Gen AI Website Traffic Share, Key Takeaways: → Gemini is approaching the 20% share benchmark. → Grok’s momentum continues. → ChatGPT drops below the 70% mark.”

Similarweb’s data echoes the findings of the cloud computing provider Cloudflare. Earlier this month, Cloudflare found that while ChatGPT remains the most popular gen AI platform, competitors like Claude, Perplexity and Gemini were witnessing faster growth over the past months.

The shift signals a transition in the generative AI market from early-stage winner-take-most dynamics toward a more competitive, multi-platform environment, where distribution, integration and differentiated use cases increasingly matter as much as raw model capability.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.