The global head of technical strategy at Fundstrat is predicting an imminent bottom for Oracle (ORCL) amid a bearish catalyst that fueled further declines for ORCL on Wednesday.

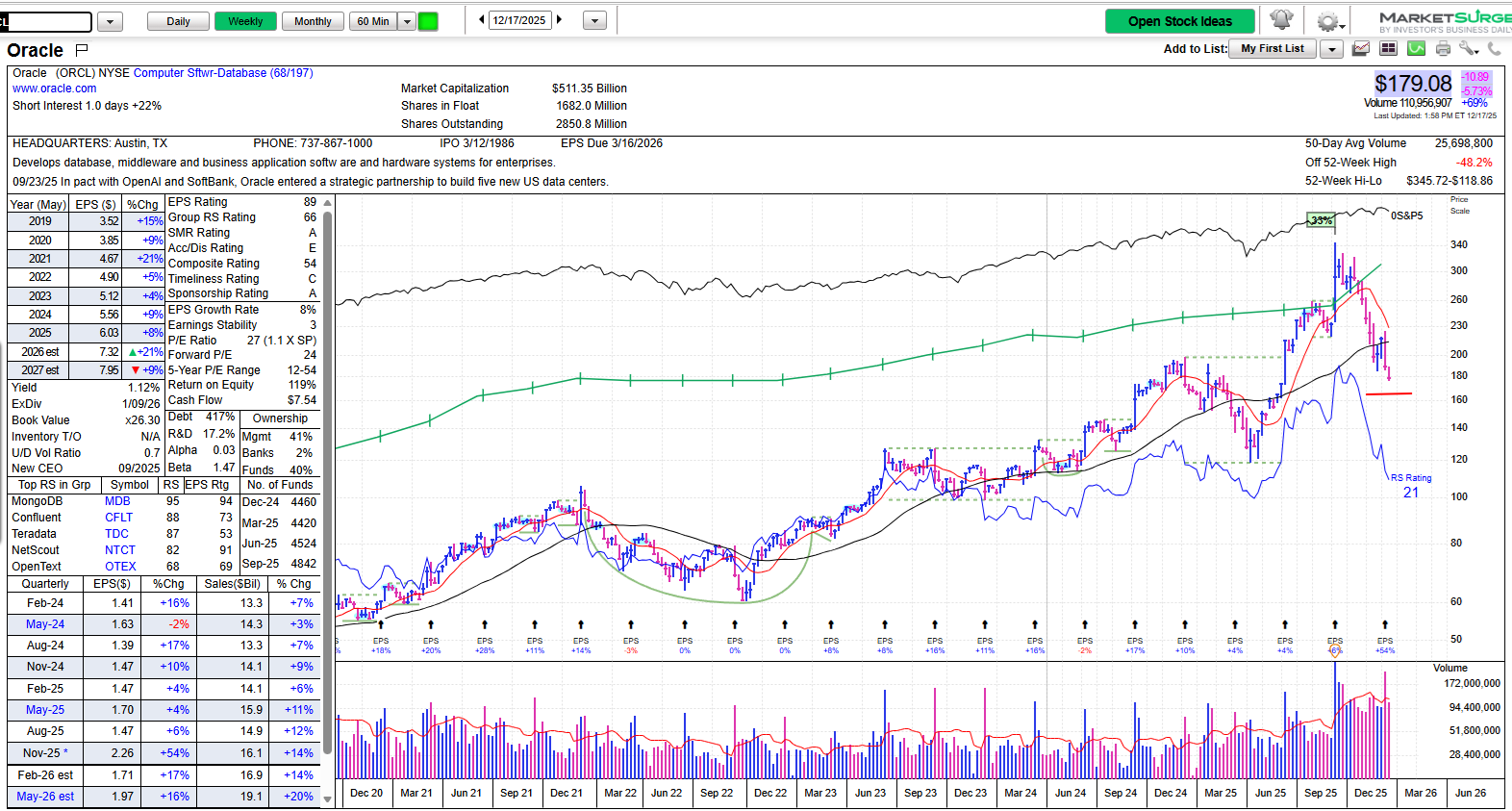

In a new post on X, Mark Newton highlights ORCL’s nearly 50% decline from its all-time high of $345.72, which it hit in September after signing a $300 billion megadeal with OpenAI.

Newton says Gann’s Square of 9, a technical analysis tool that predicts key price levels and time turning points, shows that ORCL is very close to hitting a crucial support level.

“When putting ORCL’s rally on Gann’s Square of 9 chart, which I use to convert time to price for targeting resistance and support, it’s important that ORCL’s peak of $328 lies on the 150 degree angle of Square of 9. The level of $172 looks important as support on this chart, (180 degrees to price, a few rungs lower on Sq9), which coincidentally would be exactly half of its peak on Sept. 10, 2025, of $345.72. Thus, ORCL might find support at a 50% absolute price retracement of its intra-day high from 9/10.”

To support his analysis, Newton also says the Elliott Wave theory suggests that ORCL is in the midst of a final leg down.

“Elliott-wave patterns on ORCL clearly show this to be in the final stage of a five-wave decline from September.”

The Elliott Wave theory states that a bearish asset tends to witness a five-wave decline before a bounce.

While the Fundstrat analyst believes that a bottom is in sight for ORCL, he notes that it doesn’t mean the stock will begin a new uptrend.

“Initially, being near the potential end of this decline could signal a coming bounce, and that’s what I expect. However, it also likely points to bounces not getting back to new highs right away, but resulting in additional weakness, which I feel might happen between March and October of next year. Thus, for now, it looks like a good risk/reward to buy dips technically at $172-3 this week if reached. Thereafter, a rally might get underway back up to $238 initially or maybe $258 before this stalls and turns lower. Overall, my work suggests this is getting close to a bottom and should happen in the next 3-5 days ideally.”

Newton’s prediction comes as news emerged that asset manager Blue Owl Capital has walked away from funding Oracle’s $10 billion data center project in Michigan, reports Bloomberg. Oracle has confirmed the development in a statement, but people close to the matter say that the data center project is chugging along as expected, with Blackstone exploring the idea of providing equity capital.

The sources also say Bank of America is spearheading a $14 billion deal to help fund the project and is in talks with other banks and investors to join the venture.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.