Former Goldman Sachs executive Raoul Pal dismisses calls for an AI-driven tech bubble.

Pal says on X that the long-term bull market of the Nasdaq 100 (NDX) is within the bounds of its long-term uptrend.

The macro expert says that in the late 1990s, the dot-com bubble exploded beyond the log regression channel, indicating the massive overvaluation of tech stocks.

“No, it’s not a bubble in tech stocks. We are less than 1 standard deviation (SD) from the trend. You can see what a bubble looks like in the late 1990s when we exploded out of the decade-long log regression channel to be multiple SDs from trend. Nothing to see, move on…”

Looking at price-to-earnings ratios, Pal says the narrative that tech stocks are in a bubble fails to take into account that price typically rises faster than earnings during periods of currency debasement.

“If debasement is 11% and GDP is 2% trend over the same period, then P/E rises by 9% per annum. This means that P/E ratios double over eight years or so. It’s the denominator effect.”

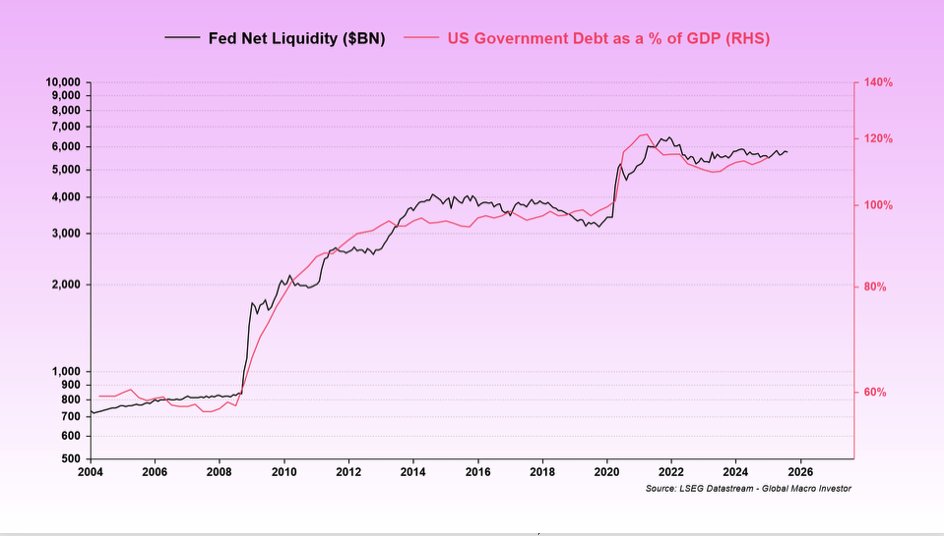

Pal notes that America’s almost $38 trillion in national debt is pushing liquidity via debasement.

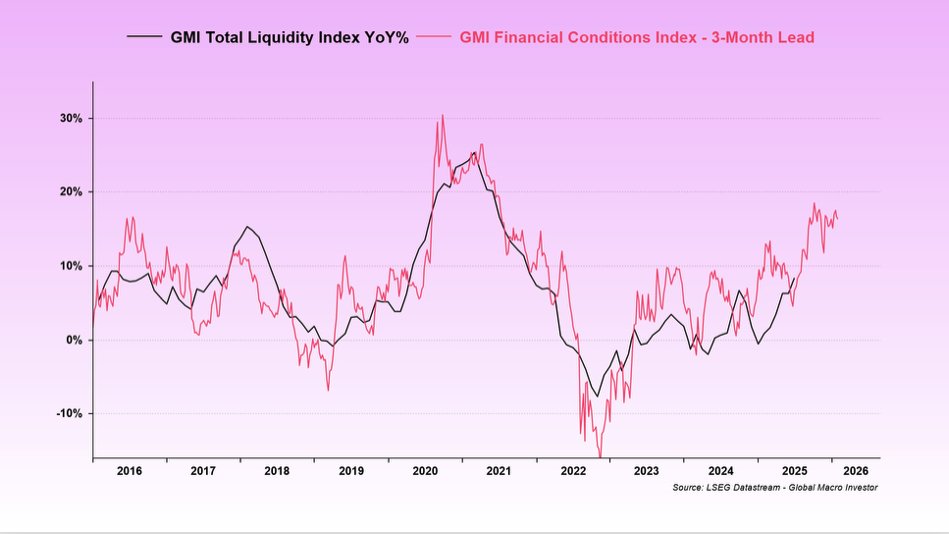

Zooming out, the macro expert says global liquidity has been on the up and up since 2022.

“Thus, the bulk of liquidity is delayed and forward-looking indicators suggest it lies ahead…financial conditions give us a three-month lead…

BUT, this is not just a US game. Back in 2017, the Fed was raising rates, doing QT and total Fed Net Liquidity was flat, but China and the UK drove total global liquidity, which meant number go up. Total Global Liquidity is THE game. It is THE debasement of fiat…”

Pal believes that rising global liquidity, fueled by currency debasement, is the main driver pushing the Nasdaq to record levels.

“And that all drive number go up… NDX has a slight premium currently but that is normal at this phase.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.