Jeffrey Gundlach is flagging early warning signs beneath the surface of the AI trade, arguing that credit markets are starting to behave in ways that suggest rising stress among high-flying technology names.

In a new video update, the billionaire “Bond King” and DoubleLine Capital founder says he’s seeing signs of unusual dislocations in corporate credit spreads tied to AI-exposed companies.

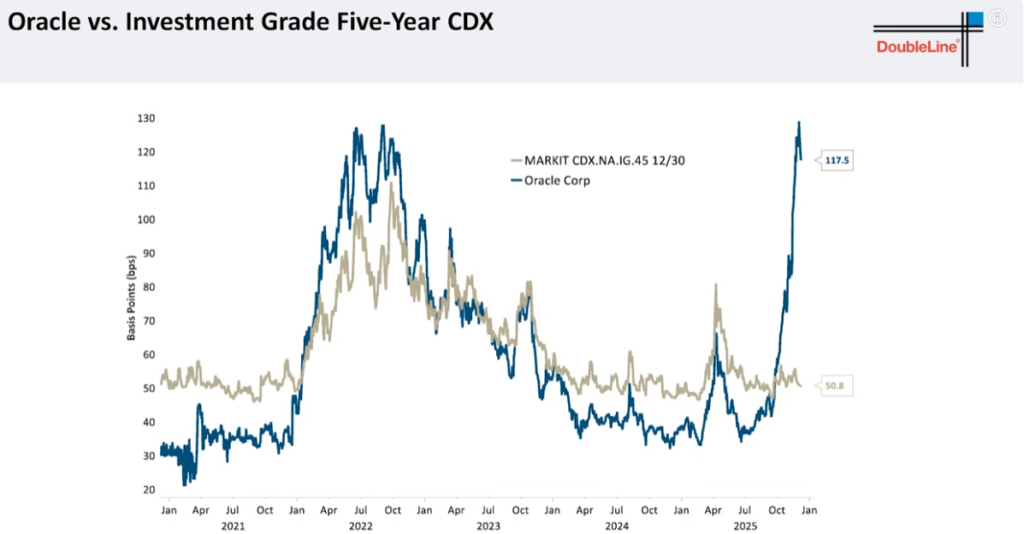

Gundlach highlights Oracle as a key example, noting that its credit performance has sharply diverged from the broader credit default swap index that it typically tracks.

“But suddenly Oracle has gotten very, very disconnected from the CDX market broadly. This is being touted as happening because people want to hedge their bets against some of the high-flying stuff that’s been driving the stock market. Magnificent Seven, the AI and all that stuff.”

According to Gundlach, the Oracle credit stress reminds him of what happened to an insurance giant that had to be rescued by the federal government during the 2008 financial crisis.

“And so if you are demanding more for CDX, it means people are starting to hedge, perhaps, some of the book that they have exposed to these high-flyers by getting involved in Oracle. That reminds me of AIG back prior to the global financial crisis, when Wall Street was hedging some of the securities that ended up being bad securities by shorting AIG, for example, and causing stress on the company. So this is some interesting developments that suggest we’re not in the early, early innings of the activity in these high-flying situations.”

In November, reports emerged that the value of five-year credit default swaps (CDS) tied to Oracle had exploded by over 200% in just a few months, as investors hedged against the risk that the cloud computing company could default on its debt.

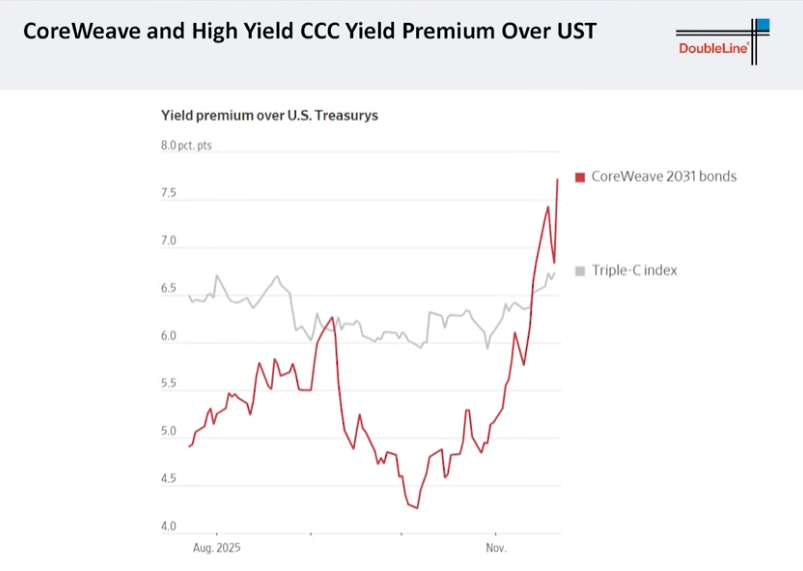

Gundlach adds that similar signals are now appearing in the AI-linked infrastructure play CoreWeave, where credit spreads have moved far more aggressively than the broader high-yield market.

“This is also true of CoreWeave, where it’s disconnected from the CCC index. The premium over Treasuries on triple-C debt has expanded about 75 basis points, but in this case, the spread has gone up by about 250 basis points.”

While Gundlach stops short of calling an imminent collapse, he warns that these divergences suggest the AI trade may be further along than many investors assume.

“There are some cracks developing if you take the time to look granularly beneath the surface.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.