Billionaire investor Chamath Palihapitiya says the AI race can be boiled down to a simple equation, while Apple largely stays on the sidelines.

In a new post on X, Palihapitiya lays out what he calls a “simplified conjecture” about how intelligence scales, noting that breakthroughs in artificial intelligence depend on three multiplying forces.

“I have a simplified conjecture about AI progress. Your mileage may vary, but here it is. f(i) = p × c × a where i=intelligence, p=power, c=compute, a=algorithms, multiplied together. This means neglecting any variable creates a ceiling and any breakthrough compounds across all three.”

Palihapitiya says the biggest technology firms are now operationalizing that formula by aggressively stockpiling power, compute and algorithmic talent.

“One caveat is that today’s advances are more accurately shaped by the entire history of prior investment, not just a discrete investment or breakthrough in time. In other words, the variables have memory over time so that must be factored in.

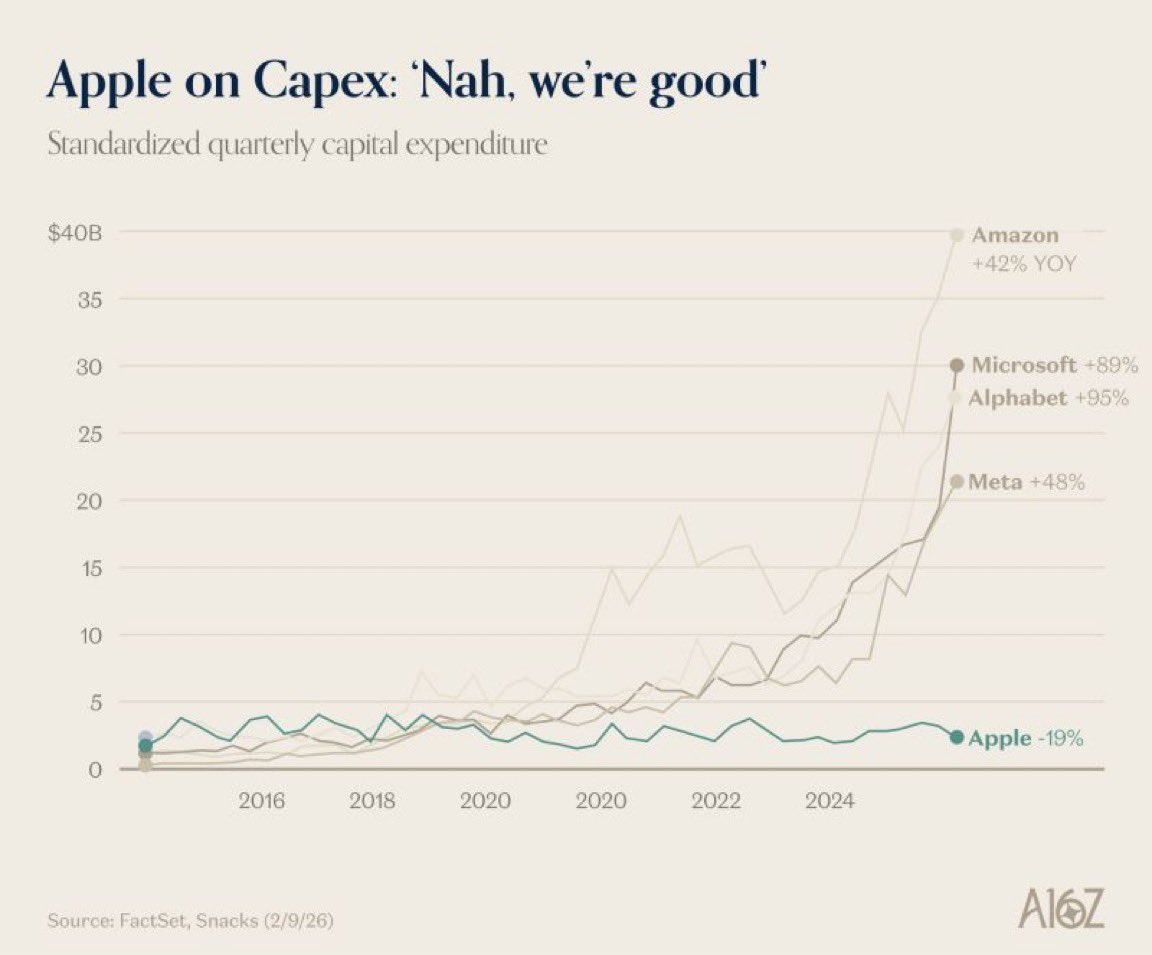

In any event, the chart below is interesting because it shows the major tech companies operationalizing this function… If f(i) accelerates quickly, there is a point in f(i) where the gap between the haves and have-nots is so stark that negotiating leverage will flip instantly. This is the bet that Amazon, Microsoft, Google and Meta are making. This is why they are buying as much of p, c and a as possible to make sure they own the leverage that comes from f(i).”

But he says one company is taking a different approach.

“Meanwhile, Apple is cutting CapEx. Apple’s implicit assumption is: ‘AI capability is an input we can buy, not a moat we need to build. We own the distribution and last mile so let’s wait and license the intelligence when a winner is more clear. It’s a feature that needs distribution not a platform that reallocates winners and losers.’”

Palihapitiya describes that stance as logical under current conditions, while warning it carries long-term risk.

“It’s a rational bet today, but it’s also the kind of bet that can look obvious until the day it isn’t.”

Earlier this month, the six hyperscalers announced their AI spend guidance this year, amounting to a staggering $655 billion. But among the group, Apple is the least spender at just $13 billion, compared to Amazon, Google, Meta and Microsoft’s allocations of $200 billion, $180 billion, $122 billion and $120 billion, respectively.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.