The hedge fund managed by billionaire Bill Ackman unloaded more than a billion dollars in Alphabet (GOOGL), while splurging on one mega-cap tech name.

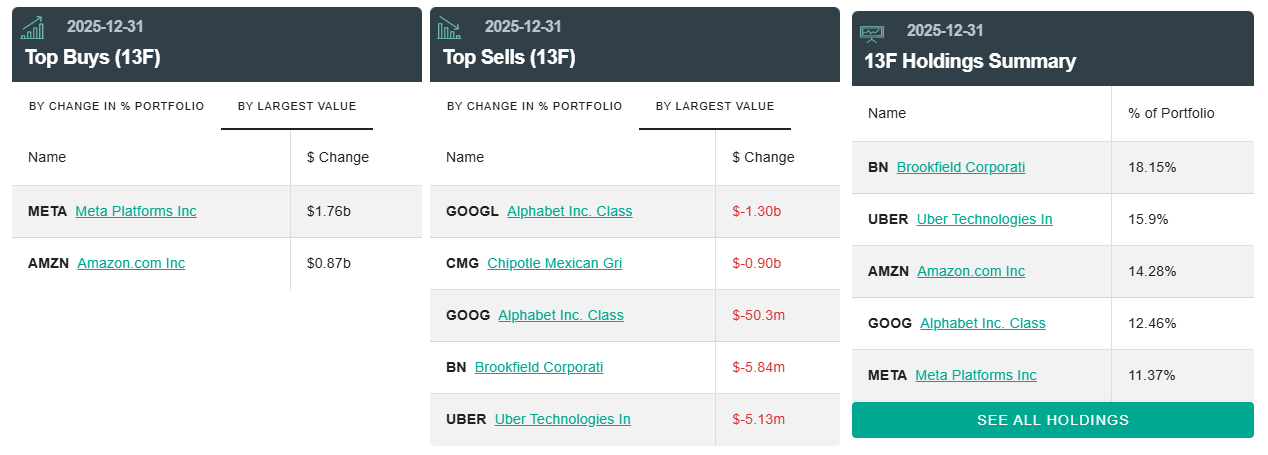

Pershing Square Capital’s 13F filing shows that it dumped $1.30 billion worth of Alphabet’s Class A shares (GOOGL) in Q4 2025 to trim its holdings by 86%.

The hedge fund sold 4,165,676 GOOGL shares last quarter, cutting its exposure to 678,297 shares valued at $212.306 million.

The firm also unloaded $50.3 million in Alphabet’s Class C shares (GOOG) in the same quarter, selling 160,160 shares to bring down its ownership to 6,163,871 shares.

Looking at the firm’s buy-side activities, Pershing Square opened a new $1.76 billion position in Meta (META), accumulating 2,673,569 shares in just three months.

Pershing Square also bought 3,784,508 shares in Amazon (AMZN), boosting its stake to 9,607,824 shares worth $2.217 billion.

Outside mega-cap tech, Ackman’s hedge fund accumulated an additional 20,382,858 shares in the global investment firm Brookfield Corp (BN.TO), to increase its holdings to 61,403,089 shares valued at $2.817 billion.

Meanwhile, Pershing Square fully liquidated its holdings in the restaurant chain Chipotle Mexican Grill (CMG). The hedge fund dumped 21,541,177 CMG shares worth $900 million.

At the end of Q4, Brookfield is the firm’s largest holding, accounting for 18.15% of its portfolio. At number two is Uber Technologies (UBER) at 15.9%, followed by Amazon at 14.28%, Alphabet at 12.46% and Meta at 11.37%.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.