Michael Burry, the investor who nailed the US housing market collapse in 2008, believes that China will emerge as the winner in the AI race.

In a new post on X, Burry says energy infrastructure, not software talent or capital markets, is the decisive factor in the global artificial intelligence race.

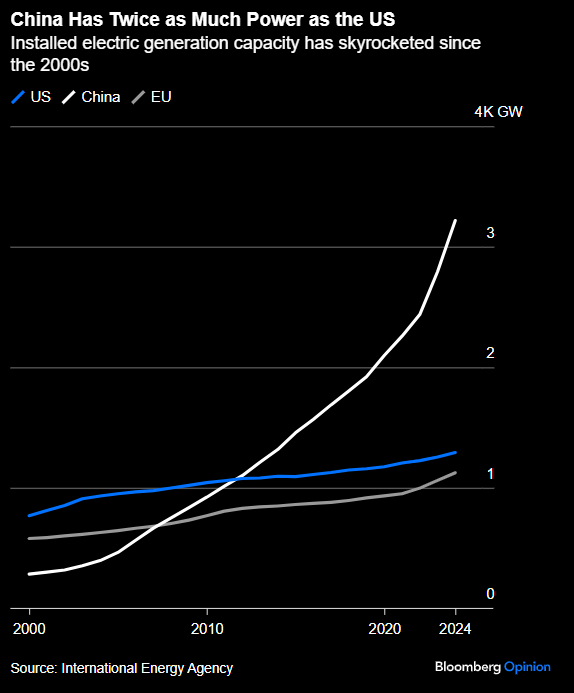

The “Big Short” investor shares a chart tracking installed electric generation capacity across China, the United States and Europe, noting that the data reveals a structural advantage that cannot be closed quickly.

“Why China will win AI in one chart: power-hungry Nvidia chips are not the way forward for the US. It is not just the total power advantage. It is the slope.”

Looking at the chart, Burry appears to suggest that the gap is not only about how much electricity China has today, but how fast that capacity has been expanding relative to the US and Europe.

By focusing on slope rather than absolute levels, Burry says AI leadership is a function of long-term energy scaling, suggesting that countries unable to rapidly expand power generation face hard limits on deploying power-intensive AI systems at the national scale.

Michael Burry is not the only personality to flag America’s infrastructure limits. Ex-Google CEO Eric Schmidt recently said that the US needs to construct dozens of large nuclear reactors in five years to power AI workloads or risk losing its technological edge to China.

Last month, Nvidia CEO Jensen Huang grabbed headlines after saying that China will win the AI race. He backtracked on his statement 24 hours later.

In late November, President Trump signed an Executive Order (EO) launching the Genesis Mission to accelerate advanced nuclear, fusion, and grid modernization using AI, among other goals.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.