Michael Burry, the investor who nailed the 2008 housing market collapse, believes that he’s once again early in betting on a market meltdown.

In 2005, Burry initiated a bet against the US housing market by buying credit default swaps on subprime mortgage-backed securities, which serve as an insurance policy that would dole out huge payments if the underlying assets collapsed.

The investor had to wait until about 2008 before generating a personal profit of $100 million and more than $700 million for his backers.

Recent 13F filings show that Burry’s Scion Asset Management holds $912.1 million worth of Palantir (PLTR) puts and $186.58 million in Nvidia (NVDA). The bets indicate that Burry is expecting PLTR and NVDA to melt down.

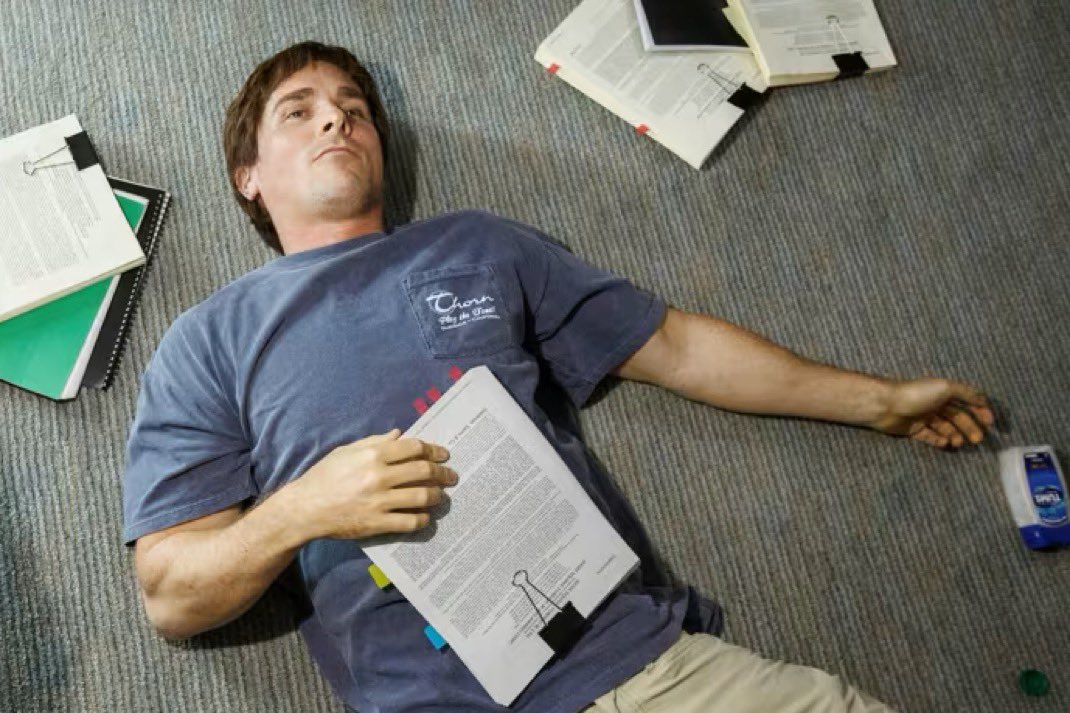

In a new post on X, Burry references his fate before the 2008 housing market collapse, when he had to wait for a few years before his prediction came to pass.

“Me then, me now. Oh well. It worked out. It will work out.”

Earlier this week, Burry unveiled the thesis behind his bearish bets, believing that hyperscalers are extending the depreciation lifecycles of their chips to boost earnings. According to the investor, AI firms will understate compute asset depreciation by $176 billion from 2026-2028.

Burry also says he plans to reveal more details about his bearish thesis on the AI market on November 25th.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.