Famed short seller Michael Burry sounds the alarm on the financial backbone of the AI buildout, warning that accounting practices across hyperscalers could be inflating earnings in a way that echoes past market excesses.

In a new post on X, “Big Short” investor Michael Burry warns hyperscalers are stretching depreciation schedules on fast-cycling compute hardware, boosting earnings in a way he likens to past financial manipulation.

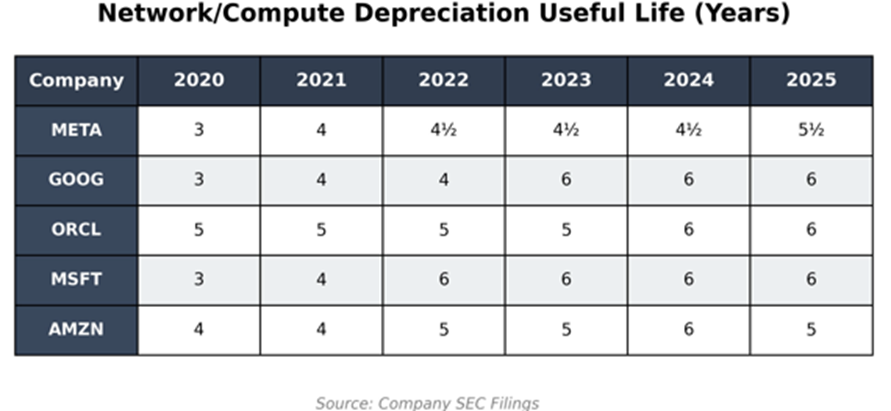

According to the contrarian investor, AI giants will understate network/compute depreciation by tens of billions of dollars in the coming years.

“Understating depreciation by extending the useful life of assets artificially boosts earnings -one of the more common frauds of the modern era.

Massively ramping CapEx through the purchase of Nvidia chips/servers on a two to three-year product cycle should not result in the extension of useful lives of compute equipment.

Yet this is exactly what all the hyperscalers have done. By my estimates, they will understate depreciation by $176 billion 2026-2028.”

Burry predicts that hyperscalers, including Oracle and Meta, would significantly overstate bottom-line results in about two years.

“By 2028, ORCL will overstate earnings by 26.9%, META by 20.8%, etc. But it gets worse. More details coming on November 25th. Stay tuned.”

Burry’s table appears to suggest that AI hyperscalers have steadily extended the “useful life” assumptions for their server and networking hardware in recent years. By lowering annual depreciation expense, firms boost reported earnings and margins, while masking the true economic cost and inflating headline profitability.

Earlier this month, data from the U.S. Securities and Exchange Commission (SEC) showed that Burry’s Scion Asset Management had placed $1.09 billion worth of put options on Palantir (PLTR) and Nvidia (NVDA). His put positions appear to be speculative bets that the AI sector will collapse.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.