Anthropic says it has raised $30 billion in fresh funding, pushing its valuation to $380 billion as demand for enterprise AI tools accelerates.

The Series G round was led by GIC and Coatue, with participation from a long list of major investors, including D. E. Shaw Ventures, Dragoneer, Founders Fund, ICONIQ, MGX and others.

The round also includes a portion of previously announced investments from Microsoft and Nvidia.

Anthropic says the new capital will be used to expand frontier research, develop new products and build out the infrastructure needed to support large-scale AI systems. The company positions itself as a leader in enterprise AI and coding tools built around its Claude models.

Says Krishna Rao, Anthropic’s chief financial officer,

“Whether it is entrepreneurs, startups, or the world’s largest enterprises, the message from our customers is the same: Claude is increasingly becoming critical to how businesses work. This fundraising reflects the incredible demand we are seeing from these customers, and we will use this investment to continue building the enterprise-grade products and models they have come to depend on.”

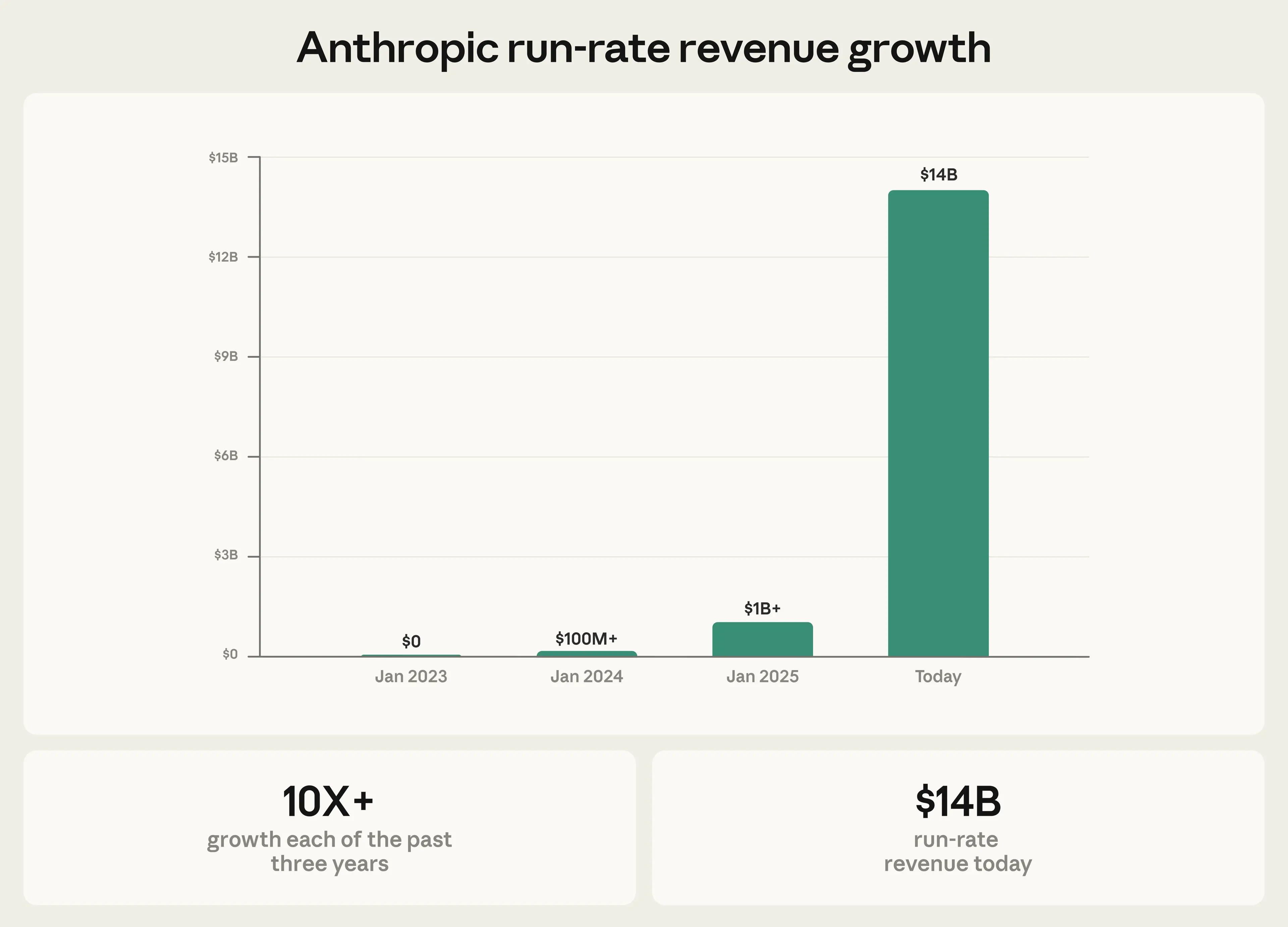

Anthropic says it has been less than three years since it earned its first dollar in revenue. Today, the company reports a $14 billion run-rate revenue, which it says has grown more than 10x annually in each of the past three years.

The growth has been driven largely by enterprise adoption. According to the company, the number of customers spending more than $100,000 per year on Claude has increased sevenfold over the past year. Two years ago, only a dozen customers were spending more than $1 million annually. Today, that number exceeds 500.

Anthropic also says eight of the Fortune 10 companies are now customers, with many businesses expanding from a single use case, such as API access or Claude Code, to broader integrations across their organizations.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.