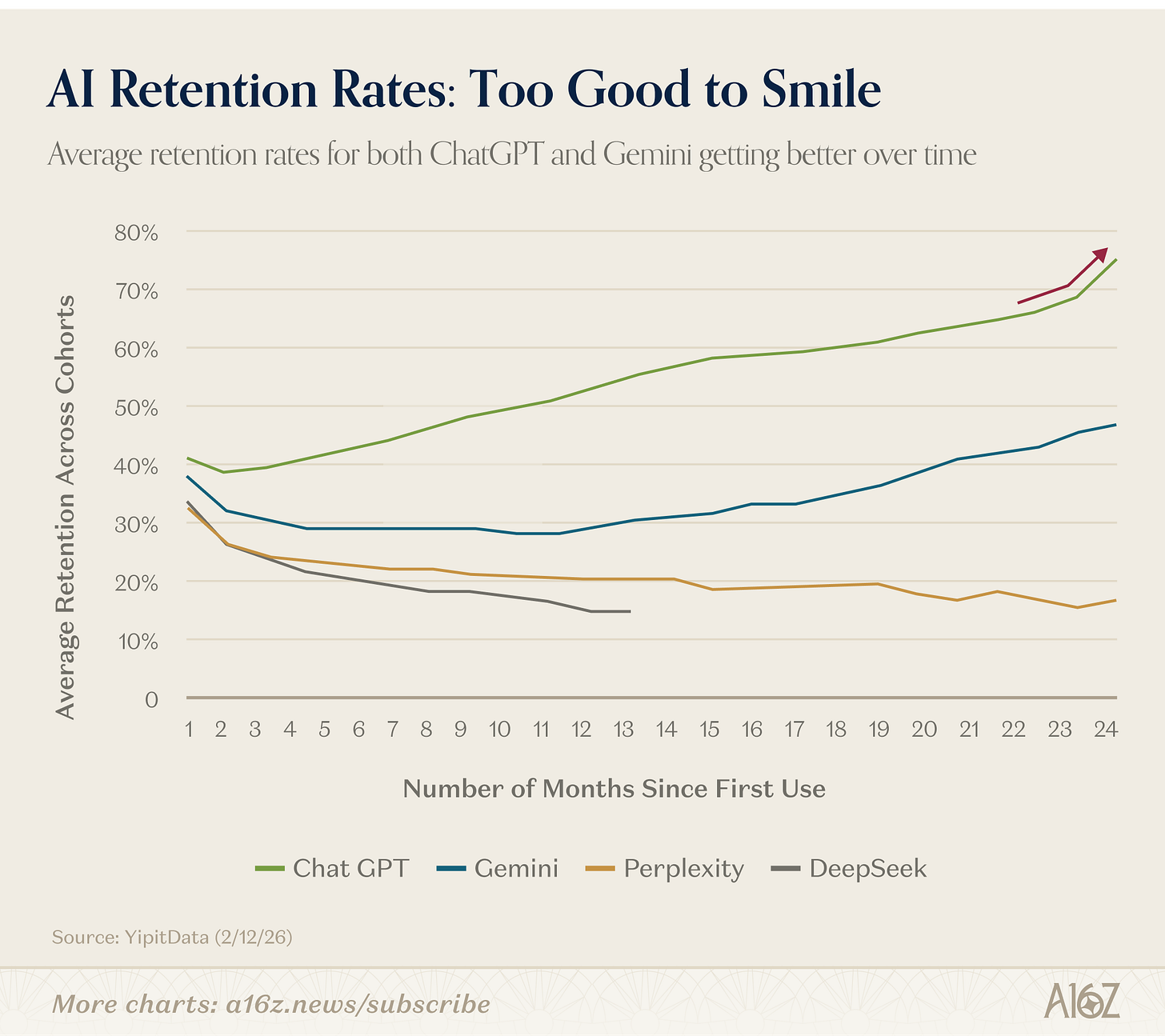

The venture firm Andreessen Horowitz says large language model apps are showing retention patterns rarely seen in consumer technology, with usage deepening rather than fading over time.

In a new analysis, a16z highlighted what it calls unusually strong cohort behavior across major AI apps, particularly ChatGPT and Gemini.

Starting with ChatGPT, a16z says the trend is highly atypical.

“Retention curves do not usually look like this: ChatGPT’s average retention rates keep getting better from week 2 onwards, and even more impressively, inflect upwards at week 23.”

Meanwhile, a16z says Gemini is flashing what is known as a “smiling” retention curve.

“Gemini, for its part, has a ‘smiling’ retention curve, whereby rates dip initially (as per usual), but then pick up again at week 10 (and continue to climb). A smiling retention curve is generally considered very impressive. It’s common for users to drop off over time, but it’s special when they start coming back after even more time.

But a retention curve that just keeps going up, and doesn’t even have a chance to smile? That’s basically unheard of, especially at this scale.”

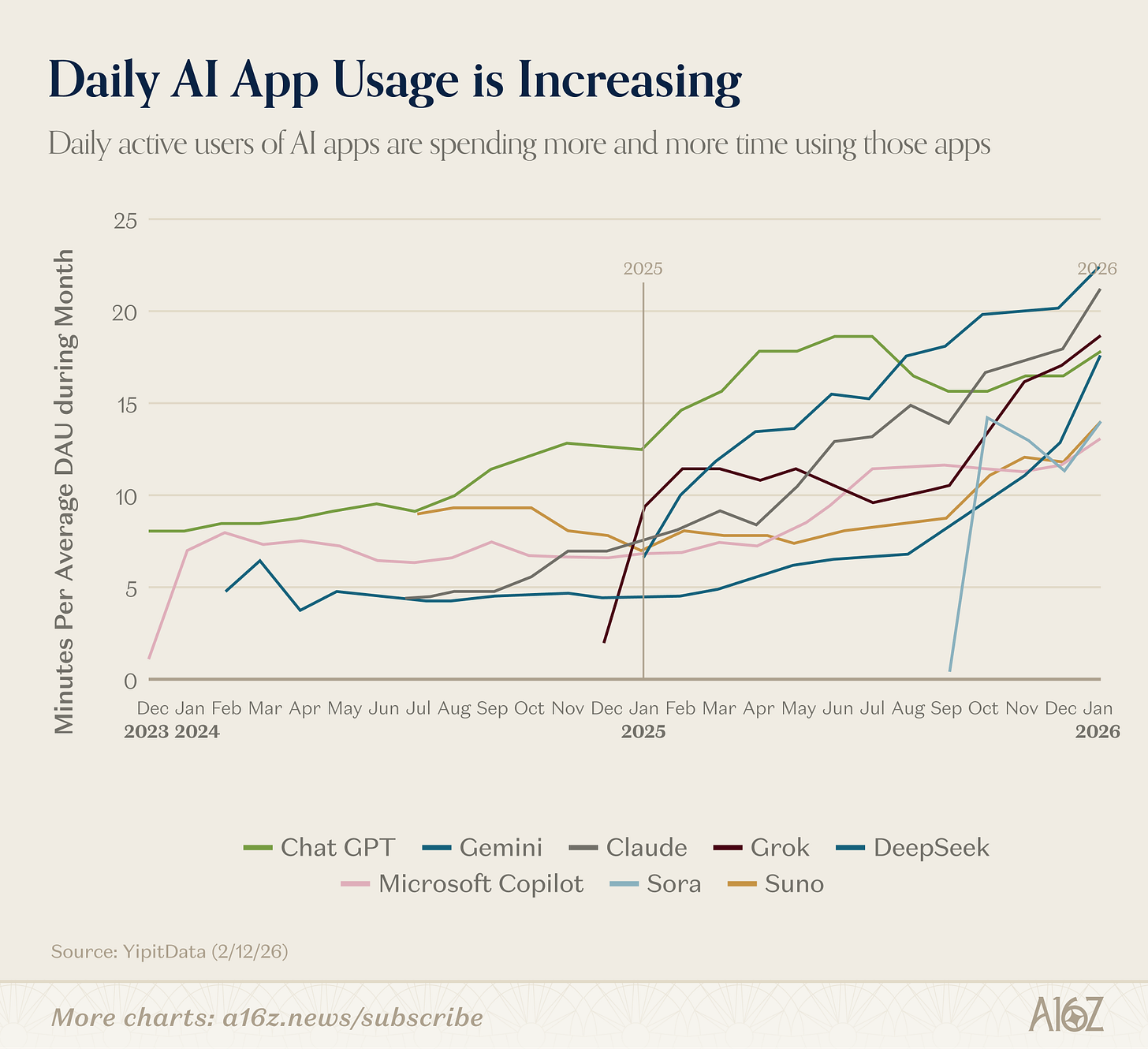

Source: a16zThe data also shows that daily active users are spending more time inside AI apps across the board.

According to YipitData figures cited by a16z, average minutes per day for daily active users is rising for nearly every app tracked. DeepSeek and Claude exceed 20 minutes per day among active users, with Grok, ChatGPT and Gemini close behind.

The combination of rising retention and increasing daily engagement suggests users are not only staying, but integrating these tools more deeply into their workflows.

The firm says the trend is evidence of a broader platform transition.

“The platform shift is well underway, and the rising tide is lifting (nearly) all boats.”

The charts imply that AI apps are beginning to behave less like novelty tools and more like durable platforms, with expanding user commitment over time rather than the typical decay seen in most consumer software.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.