Steve Eisman is warning that stress in private credit may be the early stage of a broader liquidity problem, drawing parallels to the savings and loan crisis of the 1980s.

In a new episode of the Real Eisman Playbook, the Big Short investor addresses reports that Blue Owl Capital is banning redemptions from one of its private credit funds.

Blue Owl is an asset management firm that provides massive loans to companies that don’t want to deal with traditional banks.

Says Eisman,

“There was some very negative news in the world of private equity and private credit this week. There were reports that Blue Owl was restricting withdrawals from one of its private credit funds. Specifically, investors will no longer be able to redeem shares on a quarterly basis, and the fund will only return capital through distributions funded by actual loan repayments or asset sales.”

Eisman believes it’s only a matter of time before the situation in the private credit market escalates into a full-blown crisis. He notes that growing investor anxiety is now colliding with the underlying illiquidity of the assets.

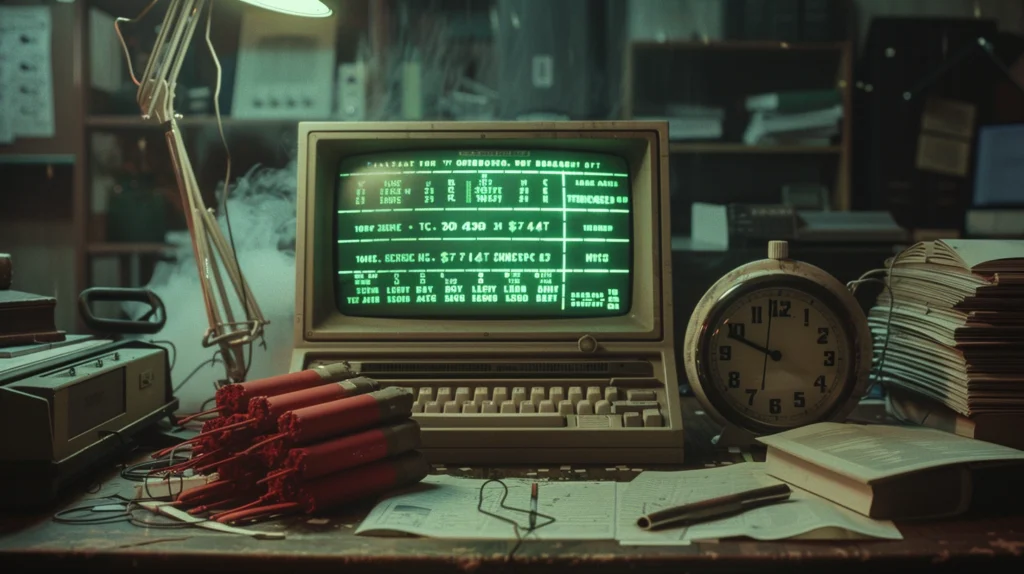

“Private equity has been selling private credit funds to retail investors for years. This has, in my view, always been a ticking time bomb. Retail investors are allowed to redeem quarterly, but the loans that the funds make are both illiquid and long-term. This is a classic duration mismatch. It’s what destroyed the savings and loan industry in the 1980s. Duration mismatches always, always create problems. It’s only a question of when.

Here, retail investors are getting increasingly nervous about the loans the private equity industry has been making. The publicity has been bad for over a year, and so they are putting in for withdrawals. However, the loans are too illiquid to meet these redemption notices. This was always inevitable.”

Eisman warns investors to expect a wave of private credit funds halting withdrawals in the coming months.

“Don’t be surprised if, over the next few months, other private credit funds suspend redemptions as well. This story is far, far from over.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.