Big Tech’s AI arms race is increasingly being financed with debt, and the numbers are moving fast.

In a new analysis, Adam Kobeissi, editor-in-chief of The Kobeissi Letter, tells his 1.3 million followers on X that AI borrowing has exploded as the world’s largest technology firms race to build out data centers, chips and infrastructure.

Citing data from Bank of America, Kobeissi says the pace of issuance dwarfs anything seen in recent history.

“AI borrowing is skyrocketing. Big Tech firms issued a record $120 billion in corporate debt in 2025 to fund AI-related investments. Issuance surged +500% compared to 2024 levels. This is also more than in the four preceding years combined.”

Kobeissi says the borrowing binge is being driven by the largest players in tech, including Amazon, Google, Meta, Microsoft, and Oracle, as AI capital expenditures accelerate faster than internal cash flows.

He warns that the debt buildup is far from over.

“Amazon, AMZN, Google, GOOGL, Meta, META, Microsoft, MSFT, and Oracle, ORCL, are now expected to issue +18% more debt in 2026, bringing the total to $142 billion.”

But Kobeissi warns that this base-case outlook may understate the scale of what’s coming if AI spending continues to intensify.

“In one scenario, they could raise as much as $317 billion, a +164% year-over-year spike.”

As AI debt explodes, the analyst warns that tech credit stress is rising at an alarming rate amid fears that artificial intelligence will eat software.

“Stress in the US tech credit market is surging:

14.5% of tech loans are now distressed, the highest since the 2022 bear market.

At the same time, the tech bond distressed ratio is up to 9.5%, the highest since Q4 2023.”

The data suggests that as Big Tech issues record debt to build AI infrastructure, the strain is already visible in software, where AI is turning once-stable software-as-a-service revenues into a credit risk.

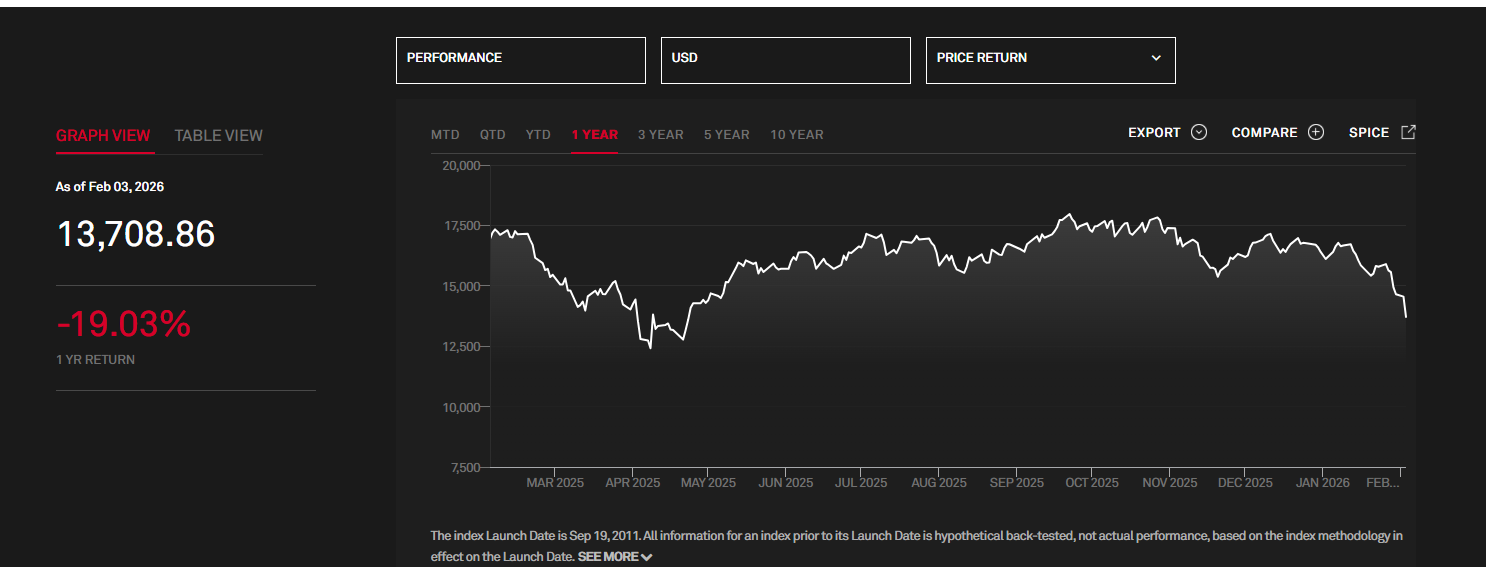

The S&P Software & Services Select Industry Index has been beaten down, plunging over 19% in just one year, indicating that the market has chosen an early loser in the AI boom.

Just in the past day, the S&P Software & Services Select Industry Index is down 5.79%.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.