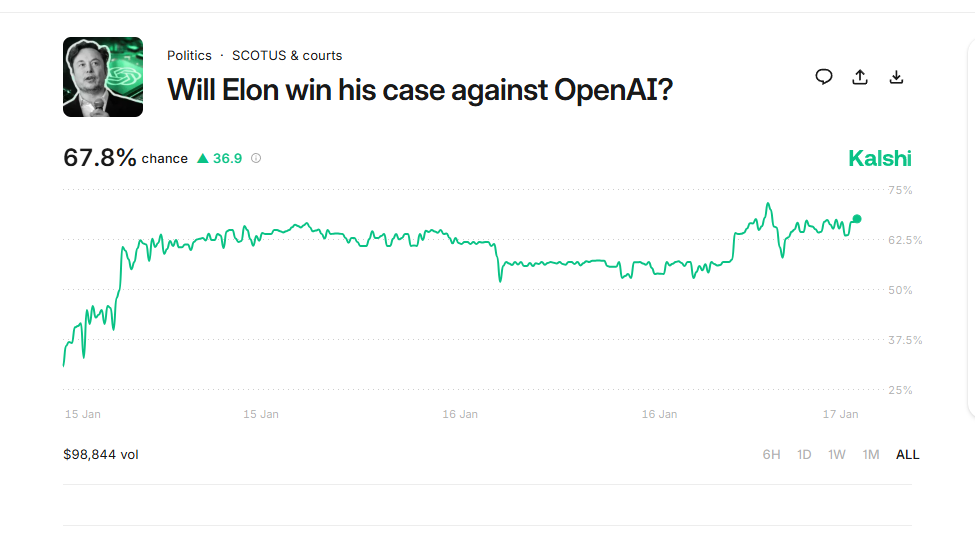

The majority of Kalshi traders are now betting that Elon Musk will prevail in his OpenAI lawsuit, after court filings surfaced private writings from a senior OpenAI executive suggesting the company’s leadership privately discussed shifting toward a for-profit structure years before it formally restructured.

Elon Musk sued OpenAI on February 29, 2024, filing the lawsuit in California state court and alleging that the ChatGPT maker violated its founding mission as a nonprofit research lab dedicated to developing artificial intelligence for the benefit of humanity, not for shareholder profit.

OpenAI moved to have the case dismissed, arguing that there was no legal basis for Musk’s claims. The company told the court that Musk never had a binding contract guaranteeing OpenAI would remain a purely nonprofit organization, and that early emails, blog posts and mission statements were expressions of intent, not enforceable promises.

“OpenAI now seeks to deny Musk any remedy for that misconduct based on technicalities. It asserts that Musk lacks standing to sue for breach of charitable trust or constructive fraud because Musk made most of his contributions indirectly – some through his personal donor-advised funds (‘DAFs’) and others through the fiscal sponsor YC.org.”

In response, Musk argues that OpenAI is trying to evade accountability by hiding behind technicalities, despite knowingly accepting his support based on explicit promises about its mission.

Court filings cite private writings from OpenAI president Greg Brockman in late 2017 that suggest senior leaders were already contemplating a for-profit shift while the organization was still presenting itself as a mission-first nonprofit.

“It would be nice to be making the billions… maybe we should just flip to a for-profit… What do I really want? Financially, what will take me to $1B?”

Following the public release of Brockman’s diary excerpts, market sentiment shifted sharply on the prediction platform Kalshi, where traders pushed the implied odds of Musk winning the case as high as 71.8%, up from 30.9% on January 15. At the time of publishing, the odds stand at 67.8%.

Says Musk,

“Can’t wait to start the trial. The discovery and testimony will blow your mind.”

OpenAI pushes back on Musk’s allegations, saying that the filing shows an incomplete context of Brockman’s entries.

“Elon cherry-picks and publishes snippets from Greg Brockman’s private journal entries (obtained as part of legal discovery) which, when read with the surrounding context, tell a very different story from what Elon claims…

On Elon’s way out, he said that he supported us pursuing the path we saw to raising billions of dollars—he just didn’t think we could succeed, and he would instead focus on building AGI at Tesla for that reason.”

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.