Goldman Sachs’ chief global equity strategist says the bull market is likely to keep running in 2026, even as high valuations cap upside and shift returns toward earnings growth rather than multiple expansion.

In its Global Equity Strategy 2026 Outlook: Tech Tonic—a Broadening Bull Market, Goldman analyst Peter Oppenheimer says the macro backdrop still favors equities, with continued global economic expansion and modest easing from the Federal Reserve.

He says that while gains are unlikely to match the dramatic advance of 2025, a major equity drawdown would be unusual without a recession.

“Given this macro backdrop, it would be unusual to see a significant equity setback/bear market without a recession, even from elevated valuations.”

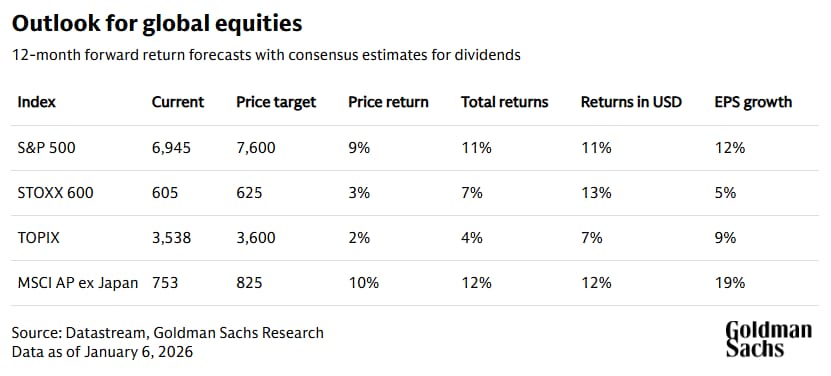

Oppenheimer notes that valuations are historically high across nearly every region, not just in the US, but also in Japan, Europe, and emerging markets. Amid an environment of elevated valuations, he expects returns to be driven primarily by profit growth rather than rising multiples.

Oppenheimer’s 12-month global forecast projects the S&P 500 rising to 7,600 this year, delivering a 9% price return and 11% returns in USD.

“Most of these returns are earnings-driven.”

Oppenheimer also pushes back against the idea that markets are in an artificial intelligence bubble. While investor focus on AI remains intense and large technology stocks continue to dominate index performance, he says today’s setup looks very different from prior speculative cycles.

“The tech sector’s dominance of markets has not been triggered by the emergence of AI. It began after the financial crisis and has been supported by superior profit growth.”

He adds that valuations among the largest technology firms, while elevated, are not as extreme as during past bubbles. In one comparison, the valuation gap between the five largest companies in the S&P 500 and the remaining 495 stocks is significantly smaller than it was at the peak of the dot-com era in 2000.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.