Billionaire investor Chamath Palihapitiya says Michael Burry’s short position against Palantir (PLTR) is fundamentally misguided, even if the company is trading at a premium valuation.

In a new episode of the All-In Podcast, the billionaire venture capitalist says skeptics who ignore Palantir’s one-of-a-kind place in AI and business will suffer.

Palihapitiya points out that, unlike MongoDB, Snowflake and other data infrastructure firms, Palantir’s business cannot be easily swapped out for a competitor.

“Well, I think the Palantir short is stupid. And I think that those people will lose money. The thing that the people who are shorting this company don’t understand is that all of these other businesses that you put up there, there is a viable competitor of some kind that you can switch to.”

He notes that Palantir is both operationally strong and uniquely positioned.

“MongoDB… It’s actually a good company. It’s an extremely well-run business, but it’s not unique. It’s just extremely well run. Snowflake is not unique, but it is well run. Palantir is both unique and well run. And there’s no clear alternative.”

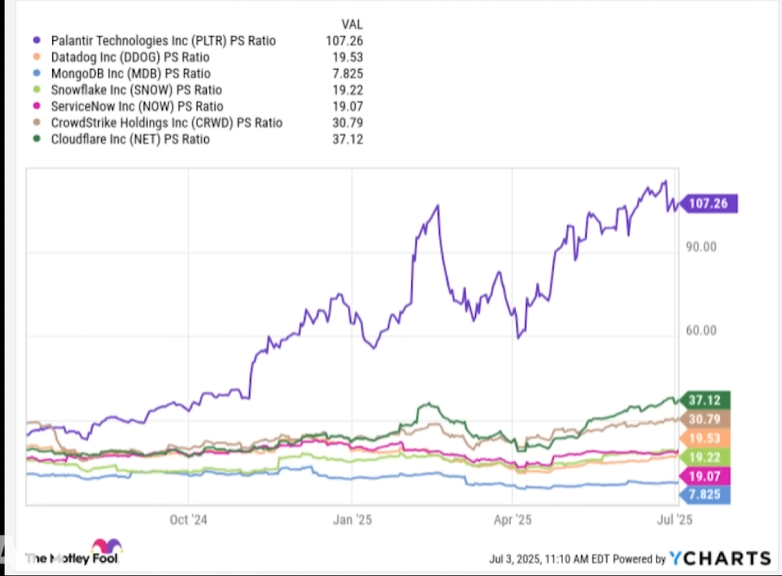

According to Palihapitiya, the lack of churn risk justifies its higher valuation relative to peers.

“So there’s no place to churn to. And so I think the reason why it has a premium valuation is because the duration and the durability of these cash flows are much longer than what you typically see in any of these other companies. And if people took one 1000th of a second to actually use their brain, they would come to that conclusion…

It’s just so obvious that what they do is completely unique and completely differentiated. There is no alternative in the market for it.”

He says the valuation reflects market dynamics seen whenever a company is the sole provider of a product or capability.

“That’s why they trade at such a huge premium to sales. And if you look at any market, for any product that is unique and is effectively where they are the only competitor for what they offer, you will see an equivalent market dynamic like this.”

Earlier this month, reports came out that “Big Short” investor Michael Burry had placed a $912 million wager that PLTR’s price would collapse. Burry has since clarified the amount of his position and said he spent $9.2 million shorting the stock.

Disclaimer: Opinions expressed at CapitalAI Daily are not investment advice. Investors should do their own due diligence before making any decisions involving securities, cryptocurrencies, or digital assets. Your transfers and trades are at your own risk, and any losses you may incur are your responsibility. CapitalAI Daily does not recommend the buying or selling of any assets, nor is CapitalAI Daily an investment advisor. See our Editorial Standards and Terms of Use.